Special Report From Our Analyst Plan

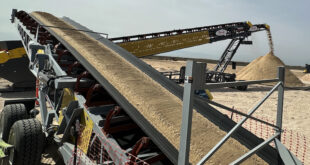

Today we introduce a special three-part series unpacking the Liberty / Schlumberger M&A deal’s nuanced implications for frac’s critical path supply chain: proppant.

Each installment offers in-depth analysis that can’t be found anywhere else, concluding with an executive summary of strategic recommendations and industry implications.

The report offers E&P operators invaluable perspective on how their supplier landscape is shifting. For senior managers and investors in the frac sand and logistics vendor community, the findings will support strategic decisions as end markets and competition are on the verge of major change.

This unique 3-part analysis series is immediately available as part of our Analyst Plan. It is also available as a one-time purchase to all Infill Thinking members for $195 per reader (this price unlocks access to all three installments). Click here to purchase or login to read.

Part 1 – Sand Producer & Mine Valuation Analysis & Implications

Part 2 – Shifts In Direct Sourcing Trends & Last Mile Logistics Solutions

Part 3 – Profit Center vs. Cost Center? This Deal’s Impact On Sand Pricing + Unanswered Questions

Address any questions to [email protected] and thanks for reading.

Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve