In the US, the O&G industry has begun to hire staff again for the first time in two years. We snapped this encouraging photo in front of a Halliburton completions yard while touring the Permian Basin in early-December.

Source: InfillThinking.com

Given what we know about the ongoing recovery and a generally accepted rule of thumb, we can make the case that the US O&G industry is in the process of adding back 30,000+ jobs.

So far in the recovery, 240 US land rigs have returned to work. Our US land drilling forecast anticipates 90+ more land rigs will return to work in 1Q17.

A rule of thumb we’ve heard is that 100 jobs are created across the energy spectrum per marginal rig, so you could argue the recovery from inception through 1Q17 will put 33,000 O&G people back to work. We recently identified a labor shortage as one of four potential choke points facing the industry in 1Q17.

Speaking to the direct hires needed to man the rigs and frac spreads that have gone back to work so far, we believe 5-10,000 field staff have already been called up and put back to work.

As evidenced by the photograph above, we have already seen first hand signs that the labor market is heating up in West Texas, where field activity is returning the fastest and the labor pool is transient.

In early-2017, the oilfield will face a test: are people that were cut in the downturn willing to return? Field hands will be one of the first areas where inflation (higher wages) is seen, and poaching will likely become an issue again early in the new year.

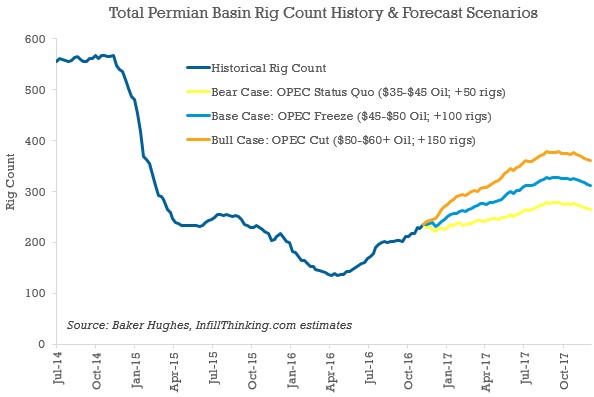

Infill Thinking’s Permian Basin Rig Count Forecast Suggests Aggressive Hiring Ahead (read more)

Contractors will face the brunt of the recruiting challenge since their onshore work is the most human capital intensive, and they’ll treat costs as a pass through to operators. Most contractors maintain call-up lists of the best field hands they’ve had to let go – HR managers are blowing up the phones trying to get these guys back as we write. Infrastructure buildout will likely closely follow the uptick in contractor activity, so look for jobs growth in the midstream sector as well.

We’ll soon see just how much of the industry’s trained labor pool has permanently left the industry for other roles.

Now check out three other bottlenecks that could slow the recovery >

Feature image photo credit: Mike Rasco

There’s a lot more to this story…

Login to see the full update…

Members get:

- Exclusive research update newsletters

- High-caliber, data-driven analysis and boots-on-the-ground commentary

- New angles on stories you’ll only find here

- No advertisements, no noise, no clutter

- Quality coverage, not quantity that wastes your time

- Downloadable data for analysts

Contact us to learn about signing up! [email protected]

Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve