feature photo image is of our favorite TexMex joint to hit up when we are in Kermit TX (tell them Infill Thinking sent you, and no they did not pay for this plug… it’s a PSA for our members in the interest of great food!) Infill Thinking keeps members abreast …

Read More »Latest Thoughts

Short Takeaways From The Sidelines Of The First Produced Water Conference Since The Pandemic

This week, we attended and participated in the only in-person produced water / water midstream conference held so far in the pandemic era – The Oilfield Water Markets 2021 Conference. And it was awesome to be back out there mingling with so many great industry folks. As the first event …

Read More »Permian Fracs Could Be Sand Constrained In 2022 [Chart Of The Day]

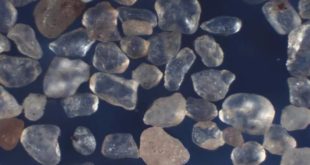

For the past couple of years, Permian sand has seemed hopelessly oversupplied. But WTX sand market won’t be loose forever… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are …

Read More »Oilfield Water – Produced & Fresh H2O Datapoint Roundup

As we prep for the Oilfield Water Markets 2021 Conference this week in Frisco, we are doing some advance research on what matters in water midstream and here’s what we found… There’s a lot more to this story… Login to see the full update… To read this update and receive …

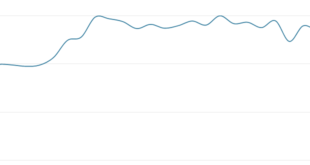

Read More »It’s Been Quite A Ride Back Up The Roller Coaster… Where Does Rig Count Go From Here?

Infill Thinking keeps members abreast of drilling trends with our weekly rig count analysis – unique takes and presentation on otherwise pedestrian rig count data… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be …

Read More »The Trucking Pain Point Is Officially A Major Oilfield Theme & A Key Shale Inflation Risk To Watch Into Mid-3Q21

An important E&P capex update this week reads distinctly negative for anyone hoping for an oilfield spending increase in 2020. Here’s the relevant excerpt: There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a …

Read More »Pressure Pumping Pricing Gains Are Inevitable. Right Guys? Right?

Our channel checks reveal some interesting things happening towards the commoditized end of hydraulic fracturing market. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, …

Read More »Simulfrac Attracts New E&P Converts With A Simple Value Proposition: “Days Are Dollars” [Simulfrac Series]

We are still waiting on a few more companies to report earnings in the oilfield; however, the lion’s share of the results are out and most calls are now behind us. So we went digging for the latest round of simulfrac talk, and we found new converts… There’s a lot …

Read More »Public Shale E&P Underspend In 1Q Creates Running Room Into Early Summer, But Capital Discipline Reigns Supreme

What’s going on with the oilfield service addressable market defined by E&P capex budgets? Data-driven insights here… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill …

Read More »Eagle Ford Frac Sand Mine Activity Trends

A data-driven look at operating activity trends for the South Texas local frac sand mining industry. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, …

Read More »Where’d All The Analysts Go? Follow The Money! [Chart Of The Day]

A data-driven look at operating activity trends for the West Texas local frac sand mining industry. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, …

Read More »Following The Leader – 5 Drilling Rig Market Takeaways From HP

Infill Thinking keeps members abreast of drilling trends with our weekly rig count analysis – unique takes and presentation on otherwise pedestrian rig count data… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be …

Read More »US Silica’s Market Outlook

US Silica provided their 1Q21 results and rest of year outlook this morning. Here is a digestible bullet point summary of the key market intel they shared… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you …

Read More »Aggressive Recruitment: 5F Triples Bonus For Sand Hauler Owner/Operators

Why it matters: Aggressive recruitment from new entrants in the frac supply chain can signal shifts in the competitive landscape and rate/cost structures. Drivers are a hot commodity and in short supply. What’s New: Several weeks ago, we flagged a new entrant in sand hauling: 5f. The app-based hauler was …

Read More »7 Market Datapoints That Stand Out From This Week’s Pressure Pumping Earnings Flurry

Over the past couple of days, we’ve listened to the conference calls of Liberty, Patterson-UTI, RPC and Calfrac (together we estimate these pumpers have X% market share in Lower 48 frac market). Here are the key datapoints that have read-through to the broader frac market… There’s a lot more to …

Read More »The Big Reveal On The 2nd Mobile-Mini Deployment In The Permian Basin…

Three weeks ago, we wrote about a new Permian sand mine opening. Now we know the rest of the story…. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are …

Read More »Quantifying The Permian Sand Mine Snap Back [Chart Of The Day]

A data-driven look at operating activity trends for the West Texas local frac sand mining industry. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, …

Read More »SimulFracs Will NOT Be A Rebundling Catalyst For Direct Sourcing E&Ps [Simulfrac Series]

Today we continue our simulfrac series with a fourth installment discussing implications for bundling vs. unbundling. Previously on the simulfrac series: “why it matters” and a thematic primer, before diving into E&P spending pattern implications. When it comes to direct sourcing… There’s a lot more to this story… Login to …

Read More »Marcellus Drilling (-) & Completion (+) Activity Trends

Infill Thinking keeps members abreast of drilling trends with our weekly rig count analysis – unique takes and presentation on otherwise pedestrian rig count data… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be …

Read More »A New Frac Outfit Joins The Fray In An Oversupplied US Pressure Pumping Market [Chart Of The Day]

On their earnings call this week, Halliburton stated that rebalancing underway in the frac market right now is setting up a price recovery for pressure pumping in 2022. Absent some big shift in the current trajectory, we aren’t so sure… There’s a lot more to this story… Login to see …

Read More »Join Us For Face-To-Face Networking & Learning At The Biggest Produced Water Event Of The Year This May!

Here in about 3 weeks (May 12-13 in Frisco TX), the produced water industry will once again gather in-person to discuss market trends. Hosted by our friends at the Oilfield Water Connection, the fast approaching Oilfield Water Markets 2021 Conference is the first in-person oilfield water event in more than a …

Read More »Halliburton Opens Up On Vorto Relationship For The 1st Time; Also Some Frac Market Outlook Takeaways…

Halliburton’s conference call this week confirmed an Infill Thinking exclusive from six months ago… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your …

Read More »New App-Based Sand Hauler To Watch… Plus 6 Other Notable “Research Quick Hits” In The Frac Supply Chain…

We hear lots of things. Some of them bear repeating… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, please …

Read More »Looking Into The Crystal Ball On Eagle Ford Drilling Trends

Infill Thinking keeps members abreast of drilling trends with our weekly rig count analysis – unique takes and presentation on otherwise pedestrian rig count data… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be …

Read More »Putting E&P Spending Seasonality On Steroids? [Simulfrac Series]

The simulfrac trend is spreading fast in shale, and rightly so. Whatever frac efficiency metric you look at – whether it’s stages/crew day or stimulated feet per month or pumping hours per quarter or time on location – the step changes simulfracs are delivering are disruptive and mindblowing. The implications …

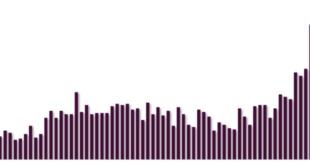

Read More »Surging Midland Basin Seismicity Is An Underappreciated Oilfield Trend To Watch

80% of Midland Basin seismic activity recorded in the past three years occurred in the last three quarters. Despite a recent seismic surge, we haven’t heard very much talk about the consequences or mitigation. This matters because… There’s a lot more to this story… Login to see the full update… …

Read More »What Ever Happened To Frac Hits? [Chart Of The Day]

Sure, companies have developed coping mechanisms, but it’s still a big risk in the medium- to long-term outlook for U.S. oil production… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If …

Read More »How Many Meshes Do Shale Wells Really Need?

As most Infill Thinking readers know, E&P operators often require their pressure pumpers to use multiple size grades on shale / tight oil wells. In fact, several grades are often used in the same stage. Is that about to change? There’s a lot more to this story… Login to …

Read More »Permian Drilling Permits Spring Upward Pointing To Summer Upside For Rig Count

Infill Thinking keeps members abreast of drilling trends with our weekly rig count analysis – unique takes and presentation on otherwise pedestrian rig count data… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be …

Read More »A Dozen Or So Notable Frac Supply Chain Datapoints

We hear lots of things. Some of them bear repeating… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, please …

Read More »US Onshore Drilling Summary – Week Of 4/1/21

Infill Thinking keeps members abreast of drilling trends with our weekly rig count analysis – unique takes and presentation on otherwise pedestrian rig count data… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be …

Read More »How, What, Where, Why, Why Now, & Who? [Simulfrac Series]

This week, we launched a new research series covering the implications of simulfrac adoption across the completions market. The series kicked off with thoughts on why it matters and future thought pieces will trace the trend’s ripples into specific niches of the US shale value chain (like sand and water …

Read More »Vanishing Idle Time In Fracs – Breaking Down The Next Big Step In Shale’s Efficiency Journey [Simulfrac Series]

The simulfrac trend is spreading fast in shale, and rightly so. Whatever frac efficiency metric you look at – whether it’s stages/crew day or stimulated feet per month or pumping hours per quarter or time on location – the step changes simulfracs are delivering are disruptive and mindblowing. The implications …

Read More »And The Hottest Topic At The Houston Frac Sand Conference This Week Was… Drum Roll Please…….

Big kudos to Pete Cook and the Petroleum Connection for hosting another great sand event in Houston this week. No one does it better than that team, and it was great to see everyone in person again. Here is some of what we learned… There’s a lot more to this …

Read More »US Onshore Drilling Summary – Week Of 3/26/21

Infill Thinking keeps members abreast of drilling trends with our weekly rig count analysis – unique takes and presentation on otherwise pedestrian rig count data… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be …

Read More »10 Frac Supply Chain Trends To Watch As 2Q21 Begins

1Q21 was a whirlwind in the frac supply chain. We relived it here. Now it’s time to turn our eyes ahead to 2Q21, and we look forward to starting to do that this week at the in-person frac sand conference in Houston hosted by the Petroleum Connection. To gear up …

Read More »Infill Thinking’s Top Fifteen 1Q21 Updates

1Q21 is in the books and what a quarter it was… we look back on one wild ride to start the new year in the frac supply chain. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, …

Read More »Don’t Call It A Comeback, But NWS Is Getting Some Interesting Buzz In 2021

In 2021, NWS and out-of-basin regional sands are finding some pockets of opportunity for re-entry in the Texas market. And we believe this is almost entirely due to… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, …

Read More »The ‘Real McCoy’ In Frac Sand Demand Models [Charts Of The Day]

Over the past week, we’ve been sharing a series of data-driven reports on Permian frac sand volume trends. First, this chart of the day showed Permian proppant consumption returning to peak. The peak Permian sand piece prompted good questions about how sand can return to prior highs in an environment …

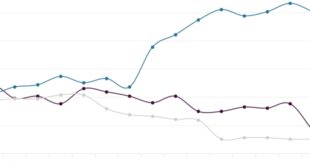

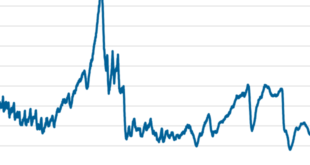

Read More »Frac Sand’s Separation From Traditional Drivers Introduces Forecasting Risks [Charts Of The Day]

Last week we shared a chart of the day showing Permian sand volumes returning to within 10% of the all-time best quarter in 2021 and breaking the record in 2022. That research prompted some rational thinking and questions, both from our members in the comments section and the EFT crew …

Read More »US Onshore Drilling Summary – Week Of 3/19/21

Infill Thinking keeps members abreast of drilling trends with our weekly rig count analysis – unique takes and presentation on otherwise pedestrian rig count data… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be …

Read More »Questions On Our Mind As Simul-frac Effects Ripple Up The Supply Chain [Panel Preview]

We are looking forward to participating in the simul-frac panel at the Frac Sand Industry Update in a couple weeks. It’ll be a great discussion with panelists from Chevron, Halliburton, Badger, and Sand Revolution discussing how this wellsite procedural change is rippling back up the frac supply chain. Here are …

Read More »MORE 1Q21 Weather Issues Plague Frac – This Time Wicked Wind In West Texas

First the freeze. Then the wind. Lost days continue piling up for the Texas frac industry in 1Q21… feature image photo credit There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If …

Read More »Texas Two Step: Sand Demand Forecasts In The Permian & Eagle Ford [Chart Of The Day]

With oil prices where they are (well above expectations for the year) and frac sand hard to find in Texas for much of 1Q21, multiple Infill Thinking members have recently inquired offline about Infill Thinking’s sand demand estimates in the big two Texas basins. This chart provides a glimpse of …

Read More »US Onshore Drilling Summary – Week Of 3/12/21

Infill Thinking keeps members abreast of drilling trends with our weekly rig count analysis – unique takes and presentation on otherwise pedestrian rig count data… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be …

Read More »10 Quick Oilfield Market Updates: Permian & Eagle Ford Sand Trends, A New Last Mile Headache, Silo System Growth, OSHA Dust Regs Sneaking Up & more…

In addition to in-depth updates published on Infill Thinking this week, some quick hits crossed our desk from contacts in the field and are worth a quick mention… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, …

Read More »Exxon’s Latest Thinking On Permian Basin Development

Exxon held their annual analyst day in early-March and released a 75-slide IR deck for the event. After wading through the first twenty slides on “new energy” (hydrogen, carbon capture, solar, wind, climate change etc.), we did find some slides that shed new light on the oil major’s plans for …

Read More »Energy Transitioning The Oilfield Out Of A Job?… Not So Fast My Friend…

Importantly as we listened to the oilfield’s commentary around energy transition this quarter, we were struck by the fact that oilfield management teams are optimistic not pessimistic about this. Remember SWOT analysis from business school? The oilfield is looking at energy transition as an “O” not a “T.” There’s a …

Read More »Controversial New Texas Bills Have BIG Implications For Frac Last Mile, Water Hauling, & Crude Hauling

New bills proposed in the Texas legislative session have potentially massive implications for insurance and commerce in the oilfield trucking business (crude, sand, water, etc. hauling in the oilfield could all be impacted). There’s a lot more to this story… Login to see the full update… To read this update …

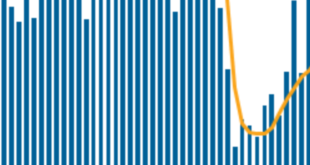

Read More »The 2021 Public E&P Spending Situation [Charts Of The Day]

Here are three charts updating the public E&P spending situation for tight oil, nat gas, and total Lower 48 in 2021 leveraging the latest Lium data with almost all the publics having now firmed up 2021 budgets and given 2020 actuals. There’s a lot more to this story… Login to …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve