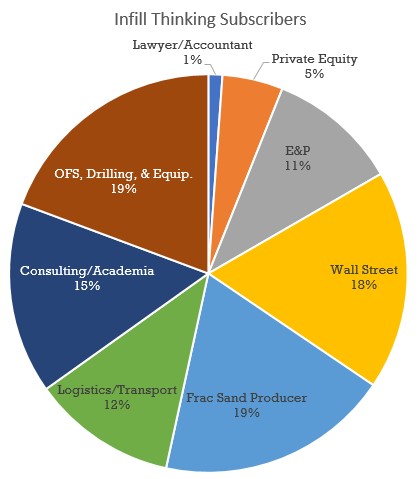

Infill Thinking membership tripled over the past three months. Before we review 2Q17 research highlights, here is some color on readership.

As of July 2017, Infill Thinking readership is comprised of analysts, business people, and executives categorized as follows:

If you haven’t subscribed (or renewed your free trial yet), please click here to do so now. Once you have joined, you can access the updates we’ll be referencing throughout this post.

Now here is a look back at some Infill Thinking research highlights from 2Q17.

Top Ten Updates

We issued 84 research updates during 2Q17. Here are links to the ten updates Infill Thinkers read the most:

- From The West Texas Sand Dunes, A Black Mountain Rises

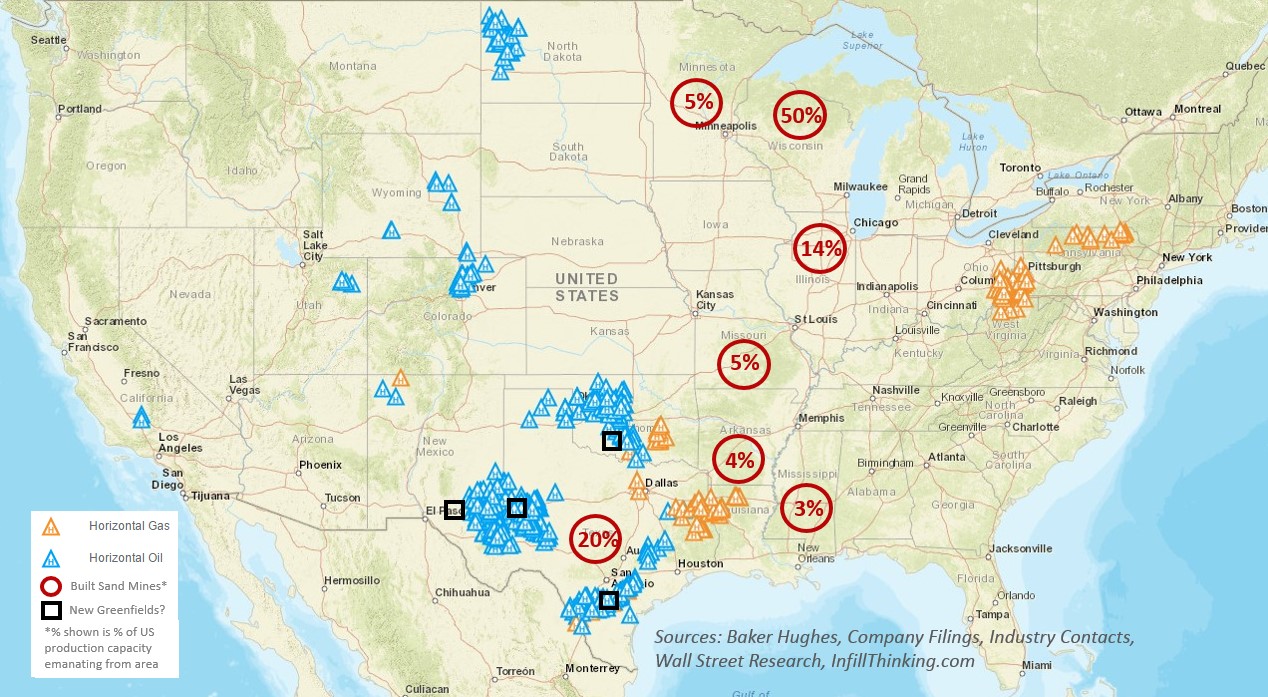

- Clarifying The Kerfluffle – Permian Sand Rush Primer [Timelines, Maps, Players, Catalysts, Background]

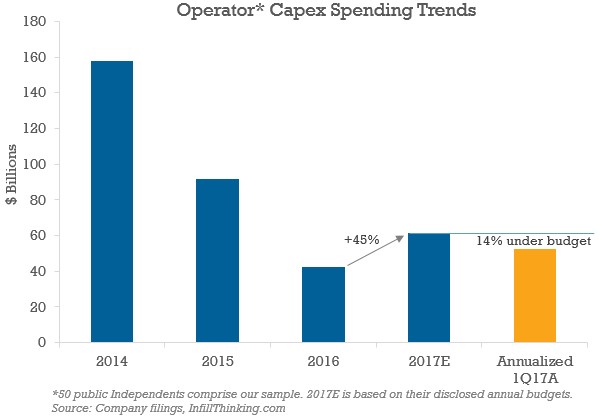

- E&Ps Actually Underspent Budget In Every Major US Onshore Play During 1Q17

- Indirect/Hidden Costs Are Posing An Increasing Threat To E&P [Guest Post]

- Some Big Names Are Behind Permian Frac Sand Mines 3 & 4. Exclusive Details Here As The In-Basin Rush Heats Up

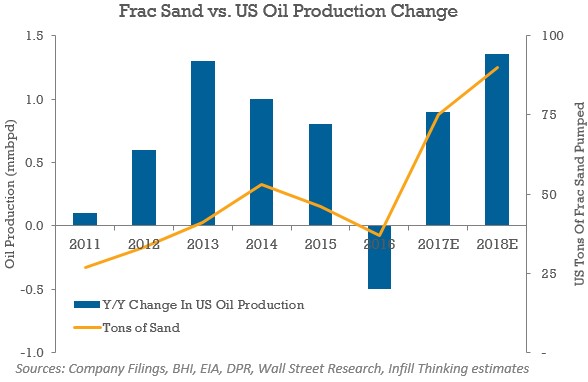

- Frac Sand Is A Substitute For Wells And Rigs. Lower 48 Surface Sprawl Is Going Underground [Charts]

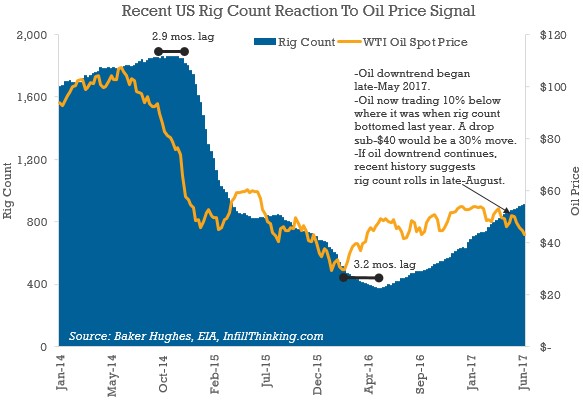

- With US E&P Sentiment Hinging On $45 Crude, A Top Five Pressure Pumper Is Already Pulling Back

- A Permian Sand Mine Challenge No One Is Talking About Yet… Thoughts On The Impending Hiring Spree

- Wall Street Blames Shale, But Shale Points The Finger Right Back

- Yeah Science! Core Lab Talks Micro Proppant, Says Three Of The Four Trends Shaping Tomorrow’s Oilfield Involve Frac Sand

Top 5 Charts

Infill Thinking is a combination of field-level intelligence gathering and data-driven insights carefully selected based on our experience to separate signal from noise.

The following five charts topped our list in terms of market importance during 2Q17:

Top 5 Newsletters

We shipped 28 newsletters during the second quarter. Our open rate averaged 62%, which to our knowledge is the highest of any oilfield publication in operation today. Based on analysis conducted by our email service provider, e-newsletters in our category average an open rate of 15-25%. Here are the five newsletters that readers found the most intriguing:

- Permian Sand News, Marcellus Scale, Shale Turns A New Leaf? and more…

- $45 Hinge, Frac Pullback, Sand Scattershooting, Big Data Pitfalls, E&P Tone Shift, and more

- Beware The Sand Bull Stampede, Permian Leading Indicator, Delaware Doozy, and more…

- Permian Mine “Hoopla,” Micro-proppant, Trade Ruling Analysis, Mines vs. Rigs, Yeah Science!

- Convict Poker In The Rig Market, Mammoth Sand Sale, Drilling Reversal, and more…

Top 5 Debates & Controversies

Controversy on oilfield market direction ran high during 2Q17. This was a quarter of fast paced growth in the Lower 48. But as the quarter progressed, falling oil prices called the recovery’s sustainability into question.

Based on reader feedback and conversations with many of you offline, here are the topics we wrote on during 2Q17 that sparked the most debate. The jury is still out on the final answer on these, but you can bet we’ll be writing about them for the rest of the year!

- Permian frac sand mine viability / scale. Can challenges be overcome, will the mines work, and how much Northern White will they displace? This continues to be the oilfield supply chain niche drawing the most attention from the capital markets and industry at the moment.

- Upcycle sustainability. How long will the Lower 48 growth trajectory extend given the volatility in oil prices?

- 2H17 E&P Capex. Will it be spent in accordance with budget plans even though oil prices haven’t performed as expected when budgets were set?

- Widening disconnect in sentiment and field activity. Wall Street and the press have never been more negative even as Permian service providers say they can’t keep up with demand.

- Last mile solutions. The market seems to be realizing that the status quo is not a permanent solution given the volumes of sand and water that frac is on track to consume in the years ahead. But what solution wins in the long run? Operators, PEs, and sand miners are all evaluating new ideas.

2Q17 Guest Contributions (Listed In Alphabetical Order By Author Last Name)

Included in our newsletters each Friday in the final month of each quarter is an original update penned by a hand-picked guest contributor. These folks are smart Infill Thinking subscribers just like you who have something interesting and fresh to share.

Each of our contributors grants Infill Thinking 30 days of exclusivity on their contribution, so you may see these stories elsewhere in the future, but you saw it here first! Also, while contributors may reference their firms, we carefully screen and work with authors to ensure that you aren’t reading “advertisements” – we have no financial arrangement with any of our contributors and we don’t allow thinly veiled commercials.

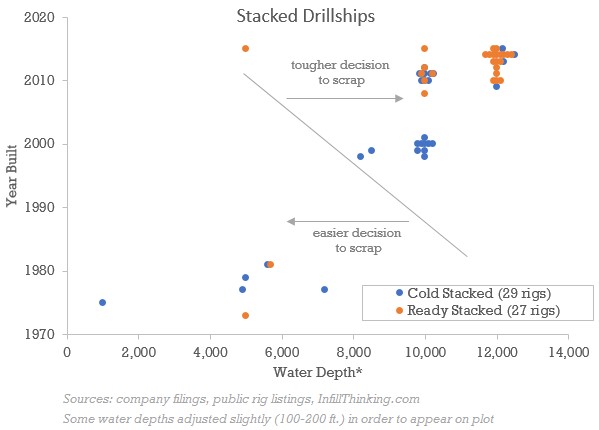

- Ron Davis: When It Comes To Managing Drillship Effective Supply, Contractors Are Playing A Game Of Convict Poker

- Jonathan Dunnett: Do Turbulent Times Spell Increased Litigation In Oil & Gas?

- Jacob Gritte & Adam Hughes: Indirect/Hidden Costs Are Posing An Increasing Threat To E&P

- Steve Matthews: Henry Ford Didn’t Build A Faster Horse And Neither Should You – 3 Big Data Mistakes The Oilfield Keeps Making

- Liz Tysall: The Reconstruction Of The Jackup Market

These guest posts have turned out to be a terrific addition (we have the smartest readers in the business). We will be featuring five new guest authors in September. Special thanks to our contributing members and everyone that commented on a story this past quarter as well. Your thoughts make this platform stand out from the rest, and we look forward to learning from you in the weeks and months ahead.

There’s a lot more to this story…

Login to see the full update…

Members get:

- Exclusive research update newsletters

- High-caliber, data-driven analysis and boots-on-the-ground commentary

- New angles on stories you’ll only find here

- No advertisements, no noise, no clutter

- Quality coverage, not quantity that wastes your time

- Downloadable data for analysts

Contact us to learn about signing up! [email protected]

Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve