Guest Contributor(s) Introduction From Joseph Triepke:

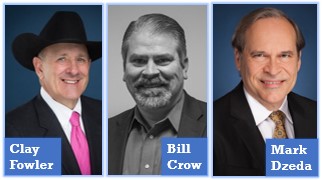

Today’s guest post comes to us from the desks of Clay Fowler and Mark Dzeda of Industrial Tax Consulting (ITC) and Bill Crow from Energy Tax Advisors. Their bios are included towards the end of this post. I’ve had the pleasure of meeting today’s guest contributors at several recent Infill Thinking meet-ups where we talked about the tax implications of the Permian Basin mining rush.

On a brand new industrial frontier in the West Texas dunes, tax nuance can be an afterthought. The focus has been on the land grab, plant construction, securing contracts, competition, etc. On top of that, some firms building in-basin mines are from out of state and have not operated a mine under the Texas tax regime before.

We asked Mark, Bill and Clay to construct a primer on the tax implications of Permian Basin frac sand mining. And they came through with shining colors, delivering the insightful overview below.

There’s a lot more to this story…

Login to see the full update…

Members get:

- Exclusive research update newsletters

- High-caliber, data-driven analysis and boots-on-the-ground commentary

- New angles on stories you’ll only find here

- No advertisements, no noise, no clutter

- Quality coverage, not quantity that wastes your time

- Downloadable data for analysts

Contact us to learn about signing up! [email protected]

feature image used with creative commons license

Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve