In an interim update posted this morning, oilfield chemical supplier Flotek positively revised its outlook to account for a more constructive US drilling and completions market as 2016 winds down. Last week we wrote about how the consensus 4Q slump is a no show this year. Flotek’s announcement provides confirmation and …

Read More »Infill Thoughts

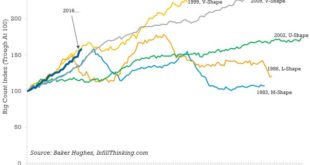

The Sharpest Drilling Rebound In US History Is Happening Right Now

The US land drilling market is exiting the worst downturn in history. Why not follow that with the sharpest rebound ever? That is exactly what is happening now. Since bottoming about 30 weeks ago, the US rig count has increased 60%. The 1985 recovery outpaced this one for 25 weeks before falling back. The only …

Read More »FRAC IPOs Return… Literally. Meet The Next Public Completions Outfit

Frac IPOs are back. We mean that literally because the company about to make its public debut will trade under the ticker FRAC. This week, Keane Group Inc., owner of the 7th largest US frac fleet and employer of 1,251, filed an S-1 for a potential IPO. The company is …

Read More »As The Fed Climbs Out Of The Interest Rate Crevasse, O&G Implications Are Mixed

The Fed raised interest rates for the second time in a decade on Wednesday. The Federal Open Market Committee raised its target range by a quarter point to 0.5% – 0.75%. The committee also expects to make three rate hikes in 2017, two or three in 2018 and three in 2019. …

Read More »In Offshore Drilling, Financial Restructuring Quietly Chugs Along As Noble And Shell Arrive At New Terms

Even when offshore drillers aren’t tapping the capital markets for debt or equity, financial restructuring is quietly continuing behind the scenes. Contractual terms continue to be renegotiated with customers, and price concessions are still being given. Literally hundreds of multi-year contracts that were in effect this time two years ago have …

Read More »What Fourth Quarter Slump?

Back in October, the North American land market was bracing for a seasonal slowdown into year-end. Here’s the warning Halliburton CEO Dave Lesar issued on a conference call about 6 weeks ago: “Based on current customer feedback we remain cautious around customer activity due to holiday and seasonal weather-related downtime. Our customers …

Read More »Chevron’s 2017 Capex Budget Is Up 45% In The Permian, But Down Most Everywhere Else

Compared to PDC Energy’s budget release earlier this week, Chevron’s 2017 continuing budget cuts are a stark reminder of the divergence theme we first wrote about in early-November. That said, these budget cuts are impacting most every area except one, the Permian. We break down the majors budget for subscribers …

Read More »The Pipe Dream Is Real. A New OCTG Business Model Is Trending In Shale

In US onshore markets, pipe has long been approached as a cumbersome consumable by the E&P industry. Suppliers haven’t historically provided much hand holding along to go with tubes sold, and many operators have found themselves practically in the pipe business themselves. In the conventional model, operators are invoiced when …

Read More »The Tenaris Midland Service Center Is Not Just Another Pipe Yard

We visited the sprawling $36mm Tenaris Midland Service Center this week. From this new Permian Basin facility, Tenaris is introducing Rig Direct™ to the US shale plays. Here Tenaris is running OCTG (casing and tubing), sucker rods, coiled tubing, and accessories in 24/7 operations. The Midland Service Center is the …

Read More »A New West Texas Yard Binds An Operator And Supplier Together For Decades

Pioneer Natural Resources is known for progressive thinking on partnerships. The company’s effluent water deal with the City of Odessa is a good example of how the company builds novel relationships to drive costs down. So when Tenaris proposed an unusual alliance around shared yard space, Pioneer listened. The end …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve