As we initiate our weekly rig count update here at Infill Thinking, it is nice to be writing about growth again for the first time in two years.

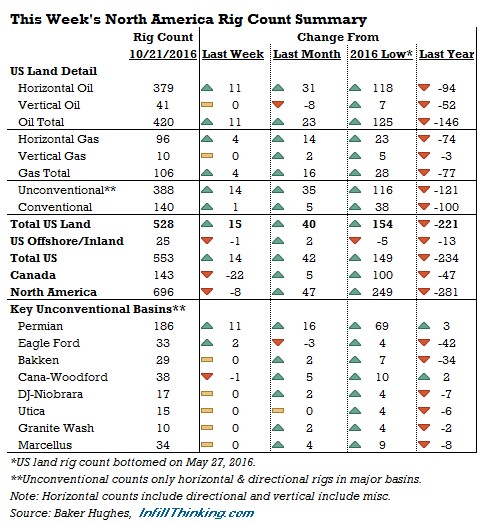

Since the May 27, 2016 bottom, the US land rig count is up 154 rigs or +41%. Recent growth has been largely driven by Permian Basin tight oil, where 69 rigs have gone back to work (almost half of the entire US increase since bottom).

We talked to an oilfield service salesman based in West Texas this week who told us that Midland and Odessa feel like boom towns again. Smaller private firms are hiring as fast as they can, gearing up for growth.

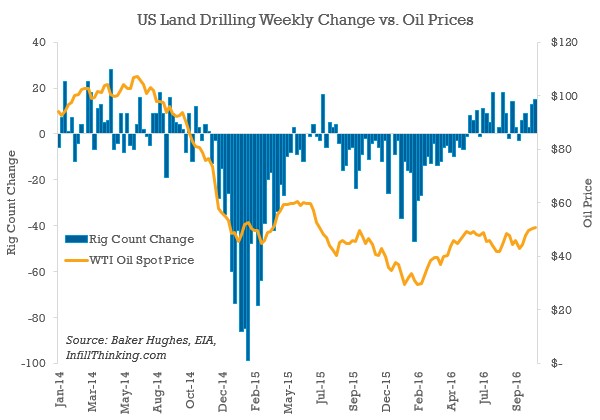

Two years ago, who would have thought $50 WTI would provide a growth signal to the market? But as long as WTI stays at $45+, our industry contacts tell us that the more nimble companies in the Permian will be inviting laid-off workers back to the office and outfitting them with F-150s. The bullish outlooks delivered to investors by Halliburton, Schlumberger, and Precision Drilling last week only serve to reinforce the confidence smaller oilfield players are feeling right now.

A personal note from the author: As we delivered analysis of this one-of-a-kind downturn to readers at another shop over the past several years, we were repeatedly called out in online forums for “rubbing it in” or “gloating” over the industry’s weakened state. This characterization was a gross misunderstanding we hope to disprove during the recovery. In fact, the industry downturn adversely impacted this analyst’s career too. Our regular response to critics was: “we call it like we see it, and we can’t wait to talk about the recovery when it begins.”

Now that the early stages of recovery are emerging, it is incredibly satisfying to be writing about growth again (just as it must be for our readers who feel the positive ripple in the patch). To be sure, this recovery will be different than before – shorter and flatter. But any recovery, even if short-lived, is better than contraction. We are enjoying writing about growth in the oilfield once again.

In upcoming weekly US land rig updates at Infill Thinking we will explore the following issues:

- How high can the US rig count go?

- Shorter and flatter – what’s the end game of this recovery?

- What (if any) bottlenecks will US drillers face as the ramp begins?

- How many rig hands have gone back to work?

- The unfair recovery: some plays are benefiting much more than others.

Weekly Drilling Update

The US land rig count rose for the fifth consecutive week, posting its second largest weekly gain this year (+15). The US land rig count is now up 154 rigs from the May bottom, with almost half of the gains coming from recovering Permian unconventional activity.

Drilling activity began to pick up in late-2Q16, about four months after oil prices bottomed. It is worth noting that although crude prices have essentially doubled from the bottom, they are still down by half from the peak. Even so, drilling activity is rising. This nascent drilling recovery at $50 oil is made possible by a combination of efficiency gains, cost reductions, well completion optimization, and high grading. The ramp up is unlikely to accelerate (and may stall) if oil prices fail to continue their recent upward trajectory.

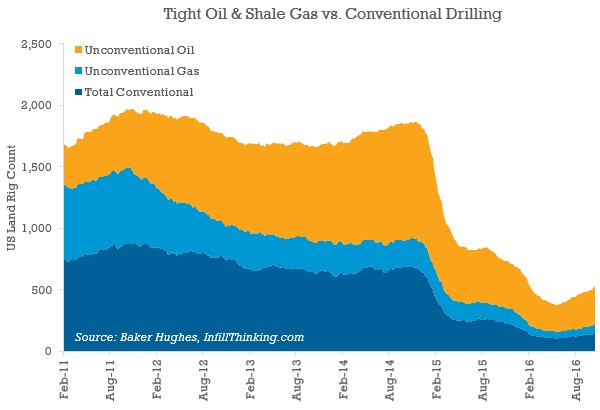

The recovery has been driven mostly by returning horizontal drilling in unconventional basins. Today, 73% of all drilling activity is unconventional up from 62% around the activity highs during 2014.

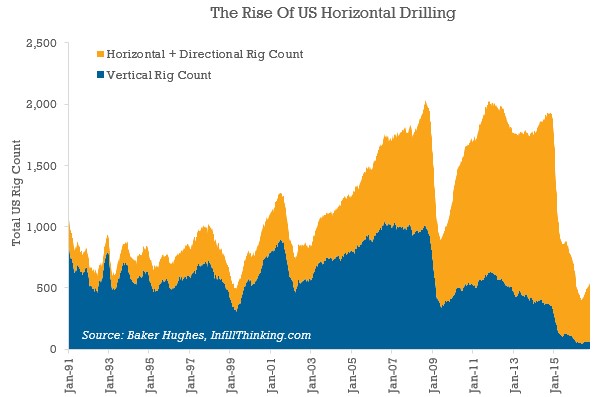

Similarly, horizontal activity has continued to take share in the US market. Today, only 10% of drilling rigs are punching straight holes. Go back to the prior trough in 2009, and 40% of the rigs working were drilling vertically. In the 2009 V-shaped recovery, vertical participation was higher.

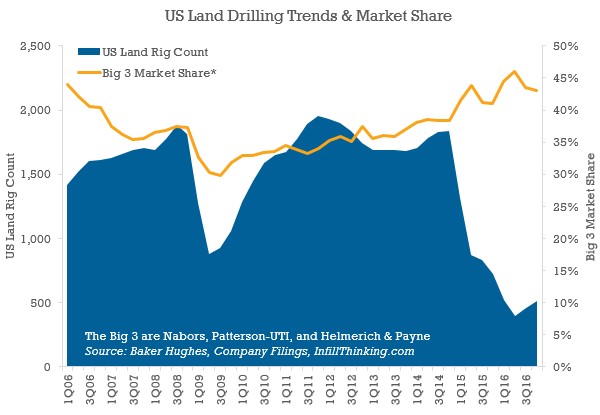

The large US land drilling contractors have taken market share during the downturn thanks to their long-term contracts and baseline unconventional activity which requires highly capable rigs. This is a departure from the prior downturn, where the Big 3 lost market share in the collapse.

In the recovery phase there will be puts and takes for Big 3 market share. Smaller contractors are bidding aggressively, hoping to take share. However, if vertical drilling (which is often carried out by mom and pop drillers) doesn’t stage a comeback, the largest contractors may continue to consolidate the market.

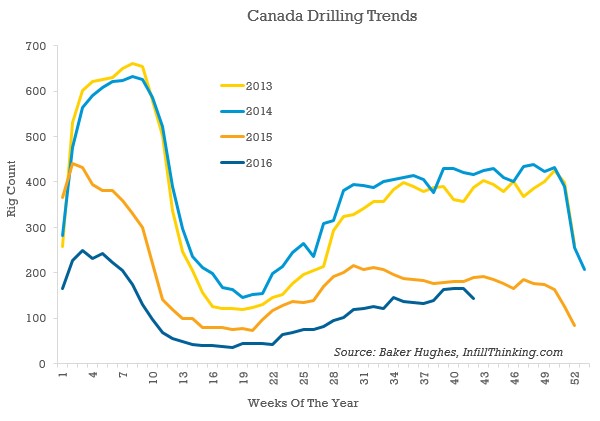

North of the border, drilling activity is flirting with year ago levels, flattening out after a multi-year decline.

There’s a lot more to this story…

Login to see the full update…

Members get:

- Exclusive research update newsletters

- High-caliber, data-driven analysis and boots-on-the-ground commentary

- New angles on stories you’ll only find here

- No advertisements, no noise, no clutter

- Quality coverage, not quantity that wastes your time

- Downloadable data for analysts

Contact us to learn about signing up! [email protected]

Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve