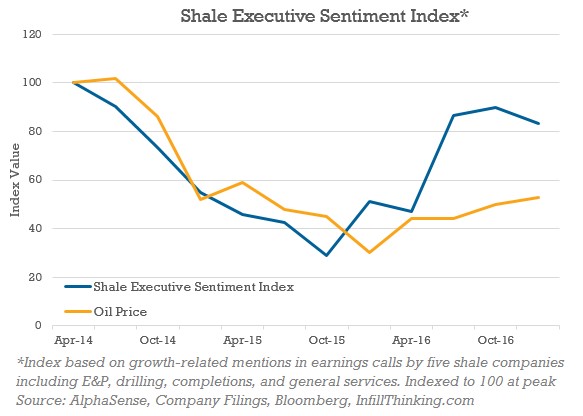

Late-last year, we introduced our Shale Executive Sentiment Index to try and gauge how management teams from drilling to service to E&P were thinking about growth in 2017.

We were able to measure sentiment by quantifying the frequency of references to growth as shale executives spoke to investors.

At the time we found that sentiment had surged back to levels last seen when oil was around $100. In this update almost two months ago, we wrote:

We expected to see resurgent optimism, but we were surprised at the magnitude we observed. Oil was trading at $100/barrel the last time executives talked this much about growing. Sentiment surged during the second half of 2016. Our index value is now 90% of prior highs. Our sentiment index did not rise during the false start oil price rally of spring 2015. Although oil prices rallied and activity picked up a bit, our executive sample wasn’t buying it. And they were right. This lends credibility to their optimism today. This means the industry has drawn a line in the sand here at $50 oil: grow or go bust trying. During 2017, this sentiment trend will certainly translate into further activity increases – the appetite for growth is strong.

The surprising strength of our index late-last year foretold a heady pace of growth that has surprised many industry observers during 1Q17. Since compiling the index, we’ve seen no less than six frac service provider IPO announcements, E&P spending budgets coming in 50%+ year-over-year, pricing up 25-30% for multiple D&C PSLs, and the first rig and horsepower newbuild orders in years.

To avoid being caught off guard, it’s important to listen closely to the guys closest to the transactions. And the executives we analyzed govern industry growth. Whether they are investing well or not, only time will tell.

In the chart above, we’ve updated our index for the latest round of conference calls over the past few weeks. We find that growth is still top of mind. Although the index slipped slightly from last quarter, the sequential change is not material – shale executives remain firmly in the growth camp.

Our Shale Executive Sentiment Index study is proof positive of the industry’s ingenuity and adaptability. It is proof that given any oil price scenario companies will adapt, learn, and be opportunistic. Two years ago, $50 oil was a signal for the industry to contract. Today, it has become a growth signal. Investment decisions are being made on break-even oil prices litterally half of what the industry was using two years ago.

Will this growth will prove profitable and well founded? We’ll have to wait and see…

PS: for those of you wondering who the six frac IPOs are, here you go:

- Keane Group

- ProPetro

- FTS International

- Liberty Oilfield Services

- Source Energy Services

- STEP Energy Services

There’s a lot more to this story…

Login to see the full update…

Members get:

- Exclusive research update newsletters

- High-caliber, data-driven analysis and boots-on-the-ground commentary

- New angles on stories you’ll only find here

- No advertisements, no noise, no clutter

- Quality coverage, not quantity that wastes your time

- Downloadable data for analysts

Contact us to learn about signing up! [email protected]

Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve