Although it may seem early to some, another fleet improvement cycle is underway for the US land rig fleet. We covered the specific upgrade programs of several leading land drillers last week in this post.

It’s a relatively humble reconstruction cycle financially speaking, involving more discrete equipment upgrades than overhauls or outright newbuilds (although a few newbuild orders are trickling in). The upgrade cycle is a product of two new market realities for demand and supply.

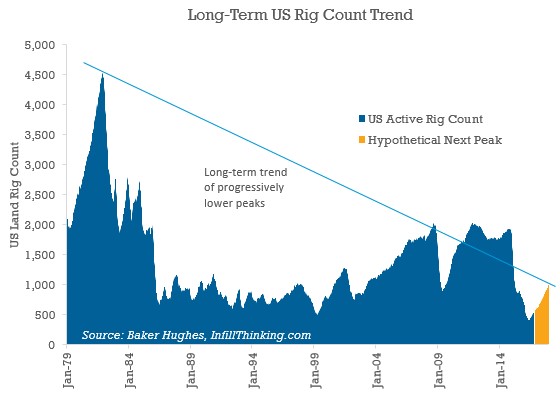

1. Spreading Acceptance Of A Lower Peak Rig Count

Most drillers now believe that the next upcycle will employ less rigs than before thanks to rig and well efficiency. The long-term pattern of lower highs in rig count supports this notion. Consensus is that the next peak will fall somewhere between 800-1,200 US land rigs.

With less potential jobs available in the future, the leading land drilling contractors are rushing to try and separate their rigs from the pack to maximize their share of the returning work.

2. Too Many Qualified Rigs

Understanding that future demand will be lower than before, land drilling contractors know that some qualified rigs that worked in the last cycle will never return to the field.

Here’s how we see the supply side:

- There are about 2,700 idle rigs in the US today.

- Around 2,000 of these are mechanical or less than 1,500 horsepower (not very competitive).

- That leaves 700 “shale ready” rigs vying for work.

- But with 533 rigs working today, the US only needs to add 250 to 650 rigs to get to the next peak (assuming the next peak is 800-1,200 rigs as discussed above).

- This means several hundred well qualified rigs could potentially never return to work.

So to avoid being left out of the recovery, contractors are stepping up their marketing efforts to differentiate their rigs and ensure work. This means talking up all the reasons their rigs are better than the next rig. And to back this up, contractors are betting that adding a few bells and whistles will give their rigs a better chance.

In our next update this coming Friday, we’ll take a look at the specific bells and whistles the ideal rig of the next upcycle will need to have to earn work.

Weekly Drilling Update

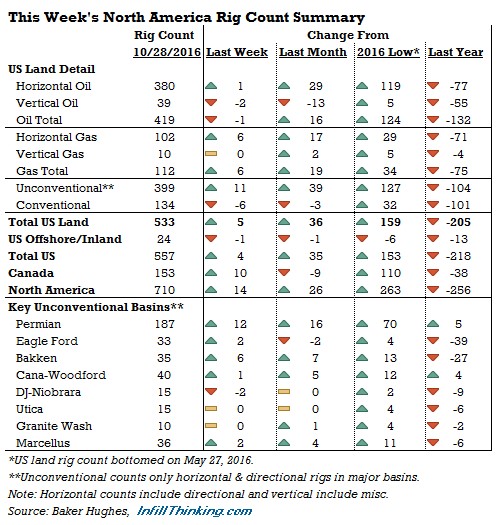

The US land rig count rose for the sixth consecutive week as five more units went back to work last Friday. The US land rig count is now up 159 rigs from the May bottom, with almost half of the gains coming from recovering Permian unconventional activity.

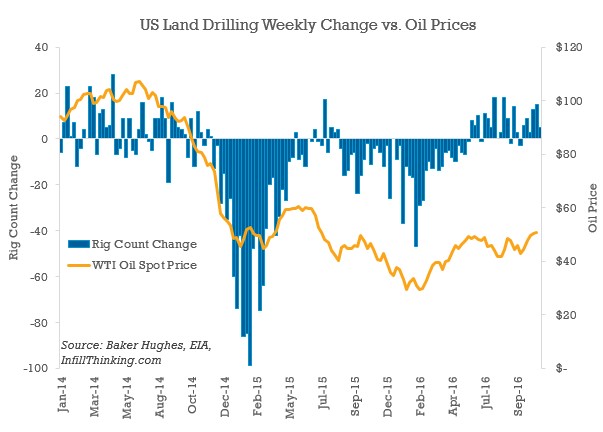

Drilling activity began to pick up in late-2Q16, about four months after oil prices bottomed. It is worth noting that although crude prices have essentially doubled from the bottom, they are still down by half from the peak. Even so, drilling activity is rising. This nascent drilling recovery at $50 oil is made possible by a combination of efficiency gains, cost reductions, well completion optimization, and high grading. The ramp up is unlikely to accelerate (and may stall) if oil prices fail to continue their recent upward trajectory.

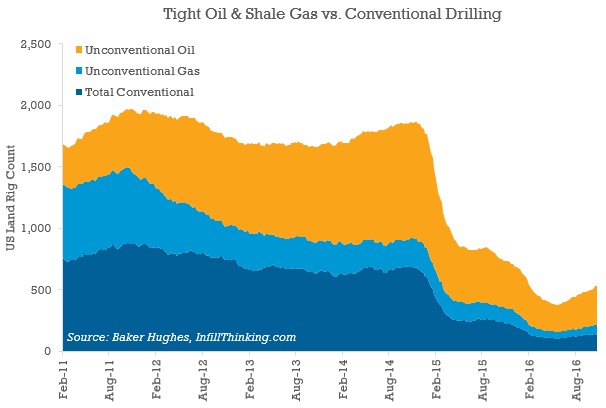

The recovery has been driven mostly by returning horizontal drilling in unconventional basins. Today, 75% of all drilling activity is unconventional up from 62% around the activity highs during 2014.

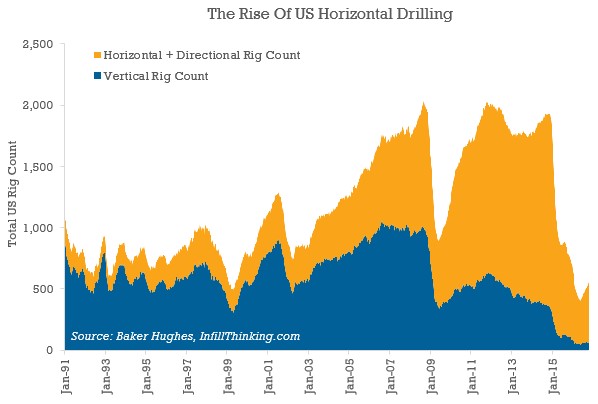

Similarly, horizontal activity has continued to take share in the US market. Today, only 10% of drilling rigs are punching straight holes. Go back to the prior trough in 2009, and 40% of the rigs working were drilling vertically. In the 2009 V-shaped recovery, vertical participation was higher.

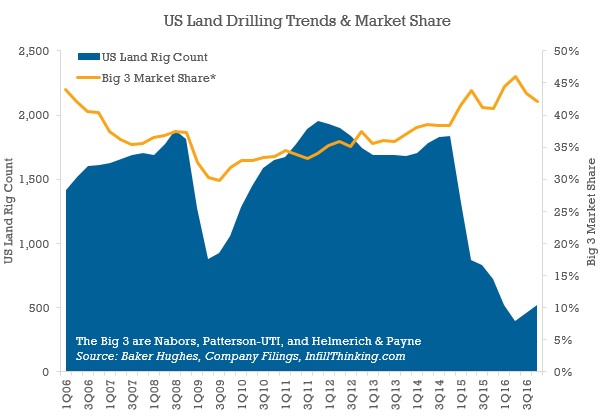

The large US land drilling contractors have taken market share during the downturn thanks to their long-term contracts and baseline unconventional activity which requires highly capable rigs. This is a departure from the prior downturn, where the Big 3 lost market share in the collapse.

In the recovery phase there will be puts and takes for Big 3 market share. Smaller contractors are bidding aggressively on dayrates, hoping to take share. However, if vertical drilling (which is often carried out by mom and pop drillers) doesn’t stage a comeback, the largest contractors may continue to consolidate the market.

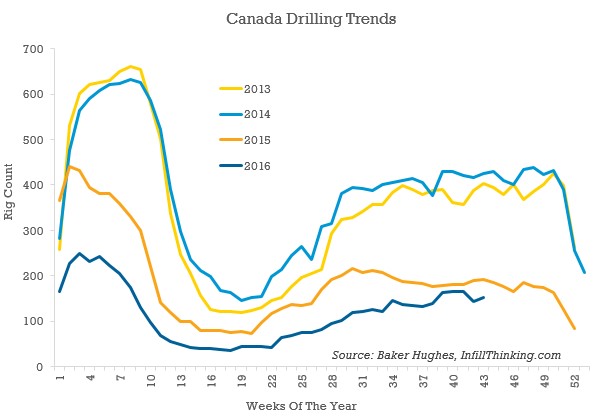

North of the border, drilling activity is flirting with year ago levels, flattening out after a multi-year decline. Summer and early fall drilling activity barely achieved the kind of activity levels of a typical spring breakup. Spending in 2017 is expected to be modestly higher than 2016, but Canada will require higher commodity prices than in the US to stage a fuller recovery.

There’s a lot more to this story…

Login to see the full update…

Members get:

- Exclusive research update newsletters

- High-caliber, data-driven analysis and boots-on-the-ground commentary

- New angles on stories you’ll only find here

- No advertisements, no noise, no clutter

- Quality coverage, not quantity that wastes your time

- Downloadable data for analysts

Contact us to learn about signing up! [email protected]

Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve