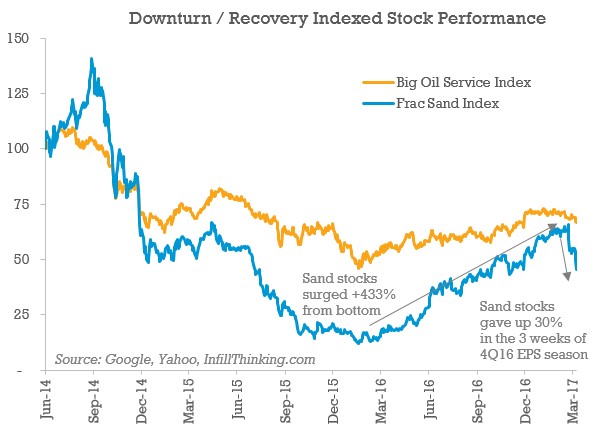

This earnings season has been rough on the sand stocks. The sell-off appears to be the classic case of a crowded trade. Sand stocks we monitor had increased 433% from the bottom about this time last year. In the past three weeks (as they reported 4Q16 earnings), they’ve fallen 30%.

Big Oil Service Index includes: BHI, HAL, SLB, WFT

Frac Sand Index includes: SLCA, HCLP, EMES, FMSA

In this post we address why and what’s coming next as well as specific details you need to know about Farimount Santrol – one of the biggest frac sand companies in the market today with ~20% market share.

There’s a lot more to this story…

Login to see the full update…

Members get:

- Exclusive research update newsletters

- High-caliber, data-driven analysis and boots-on-the-ground commentary

- New angles on stories you’ll only find here

- No advertisements, no noise, no clutter

- Quality coverage, not quantity that wastes your time

- Downloadable data for analysts

Contact us to learn about signing up! [email protected]

Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve