We examine some banking datapoints for shale E&Ps to gauge industry’s health and ability to continue forward with capex programs. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are …

Read More »March Madness – Frac Stocks Getting Crushed This Month [Chart Of The Day]

Thoughts on frac stock price performance… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, please email us to discuss …

Read More »ProFrac Spent $740mm Buying Out Frac Sand Mines Over Past 6 Months. Will The Spree Continue In 2023?

Our most read research update in 2022 (here’s a link to the top updates list) was titled “Who Else Is ProFrac Buying?”. Since that was written back in October, ProFrac announced three more acquisitions (two in sand – Monarch, Performance Proppants – and one in frac – Rev). Will ProFrac …

Read More »Mass Bankruptcy. What Does It Mean For “The 3 C’s” Of Oilfield Service?

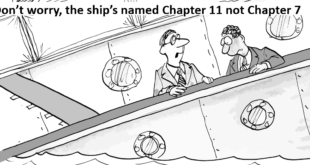

It seems like every couple days another oilfield company declares Chapter 11. Against this bankruptcy backdrop, we consider the future of oilfield services… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. …

Read More »A Boost At The Bottom – PPP Money Flowed Mightily Into The Frac Supply Chain As Crews Fell [Chart Of The Day]

Clearly, based on the following table, the PPP loan program provided a material source of capital for many smaller firms in the US oilfield at the cyclical bottom, specifically those in the often ignored frac supply chain. Good! We are happy to see that employees in this critical segment of …

Read More »This Oil Price Drop Has Triggered A Nearly Simultaneous Restructuring Response

With oilfield bankruptcy and restructuring news heating up into 2H20, the industry has fallen into low-cycle restructuring mode much more expediently than in prior cycles. We take a look at some interesting correleations and discuss what it might mean going forward in this chart of the day update… There’s a …

Read More »Bankruptcy Claims A 14th Major Casualty In Frac Sand… The Biggest Name So Far

Several weeks ago and again on Tuesday, we highlighted a group of oilfield firms that had yet to report 1Q20 earnings. We warned towards the end of the post that some might announce restructuring along with earnings. On Thursday, several of them did just that. One of them is the …

Read More »Thinning The Herd – The Public E&P Universe Is Shrinking Via M&A, Delistings

On the heels of yet another combination of public E&P operators this morning (PDC Energy and SRC Energy), we spent some time thinking about the expansion, peak and contraction of the public E&P universe. There’s a lot more to this story… Login to see the full update… To read this …

Read More »It’s Not Just E&Ps That Are Separating Oilfield Water Midstream Businesses…

We’ve seen plenty of E&P divestitures of water midstream assets to third-party water pure-plays over the past 12 months. But oilfield service firms can also benefit from… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you …

Read More »Secret Conference Rooms, Intimidating Private Investigators, And Undisclosed Private Planes… Just Another Day In The TPL Power Struggle

In the struggle for control of Texas Pacific Land Trust, accusations are flying hot and heavy. The battle between the activist investor and incumbent trustees is not just playing out in the press any more. It’s going to court. Both sides have sued each other since our last update. Here’s …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve