Amid recent volatility, our data team stress tested our predictive models and we share some insights on downside scenarios here… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are …

Read More »In Other News… More ProFrac M&A, BP Budget Bulge, Permian Production Problems, Frac HHP Bottleneck, & more…

A variety of interesting shale datapoints and anecdotes popped up in our research this week that didn’t warrant a full Infill Thinking write-up but are none-the-less worthy of a mention. Here are several of them: There’s a lot more to this story… Login to see the full update… To read …

Read More »A Patriotic Oil Production Blitz Would Require Some Brown Sand And / Or NWS Capacity Reactivation

“There decades when nothing happens; and there are weeks when decades happen.” – Vladimir Ilyich There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or …

Read More »EIA Just Increased Their 2022 U.S. Oil Production Growth Estimate By 20%

Earlier this week, we wrote that market expectations for U.S. oil production are too low (see report). In that piece, we pointed out that the EIA’s numbers only showed about 640kbpd of U.S. oil production growth in 2022. This compared to our 1mmpbd growth forecast. Subsequently, the EIA has revised …

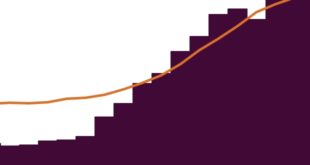

Read More »Why Sand Pumped Matters More Than Any Thing Else In Shale

A data driven look at why proppant is the best indicator of oil production known to the shale industry… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new …

Read More »1st Look At $70/BBL In The Permian… Spoiler Alert-New Record High Frac Sand Demand! [Chart Of The Day]

Oil price momentum continues. Good news from OPEC yesterday buoyed WTI above $65. What might $70 oil bring for Permian oilfield activity? The data scientists at Lium Research, our affiliate, had actually run the numbers on that very question a week before this latest oil price spike for data clients …

Read More »What Would Texas Oil Proration Look Like? A $1,000 Fine Per Barrel For Non-Compliance Is Part Of It…

We have reviewed a draft of the proration order and share it and something that jumps out at us here… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are …

Read More »Forget Frac. EVERYONE Is Talking Storage & Shut-ins

We checked in with a whole bunch of our oilfield service and E&P contacts this week. What we heard from them sure sounds like complete capitulation in the oilfield market. The bottom is coming into focus. Here’s what folks we talk to are saying… There’s a lot more to this …

Read More »As Bad As Paper Oil Prices Got On Monday, The Real Spot Bid Got Worse [Chart Of The Day]

You’ve gotta see this chart to believe it. Consider our minds blown. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has …

Read More »On The Oilfield’s Second Black Monday This Spring… One Word Comes To Mind: TEMPORARY

We know you know the logic, but on days like today, it’s good to read and re-read the crude oil cyclical rationale in it’s simplest form, which is as follows: There’s a lot more to this story… Login to see the full update… To read this update and receive our …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve