In the US onshore market, skilled workers are returning to the oilfield jobs they were doing a couple years ago en masse. We talked to a drilling consultant in West Texas this week who has been filling his days with dirt work during the downturn. He just got called back …

Read More »Infill Thoughts

I’ll Take The Worst Neighborhoods In O&G For $200, Alex

The hardest sell in the entire O&G industry right now is without question a newbuild offshore rig order. Demand for offshore newbuilds is actually negative. Contractors continue to push out delivery dates, in some cases paying up to avoid taking delivery. With little visibility on a recovery, shipyards are being forced to …

Read More »Reports From Big Sand Are Still A Few Weeks Out, So Here Are Three Datapoints To Tide You Over

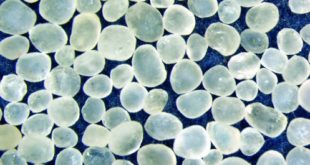

The big public frac sand suppliers (companies like Hi-Crush, US Silica, Fairmount Santrol, and Smart Sand) will be closely watched when they report earnings this quarter. Expectations for increased proppant demand are high as the US shale industry gets back to work. But Big Sand won’t be talking about their own …

Read More »Halliburton Is Reactivating Frac Spreads For A Pretty Penny

Halliburton’s strategy for 2017 is shifting, and the company will have a whole different M.O. this year. Jeff Miller, Halliburton President expressed his feelings about the new year this way: “in many ways, 2016 was like a bar room brawl where everyone, and I mean everyone, took a punch. But …

Read More »It’s A Good But Tricky Place In The Cycle For Oilfield Service Pricing

Oilfield service pricing moving higher cyclically is a good thing for all our readers (including operators, for current pricing is unsustainable and will destroy capacity in the long run). That said, we stand at a tricky juncture in the cycle for oilfield service company decision makers trying to reset their …

Read More »As 2017 E&P Budgets Kick In, Permian Rig Count Sizzles

After a brush back in the second week of the year, the US land rig count surged ahead last week. 2017 E&P budgets and drilling programs are kicking in and we expect continued strength over the next 4-6 weeks. Take out a free trial below to see our full analysis of …

Read More »Schlumberger Restores Its Focus On The Pursuit Of Growth… Outside The US Too

This morning, Schlumberger management hosted a conference call with analysts to discuss 4Q16 results and the 2017 outlook. The company kicked off oilfield service earnings season on a positive note. Following nine consecutive quarters of relentless workforce reductions, cost cutting, and restructuring efforts, Schlumberger is restoring focus on the pursuit …

Read More »FRAC Inauguration – Wall Street Loving Keane Group’s IPO In Early Action

The big to-do in Washington today isn’t the only inauguration going today. In New York, the markets inaugurated Keane Group Inc. as the newest publicly traded frac outfit today. In this update, we discuss the IPO’s early performance and introduce the newest public frac company. There’s a lot more to this story… …

Read More »8 Quick Trends To Listen For During Oilfield Service Conference Calls This Earnings Season

Schlumberger kicks off 4Q earnings season this week, hosting a conference call Friday morning to discuss the 2017 outlook. During the fourth quarter, a cyclical inflection point materialized in the US onshore market. A key question during the calls this earnings season will be how sustainable the cyclical growth trajectory …

Read More »OFS Contractors Should Cheer Noble Energy’s Acquisition Of Clayton Williams

Permian oilfield service and drilling contractors are having one great start to the year. Contractors got another dose of good news yesterday as Noble Energy expanded in the Permian Basin with the acquisition of Clayton Williams. In this update, we discuss why the deal is good for oilfield service contractors …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve