Infill Thinking has learned that… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, please email us to discuss our …

Read More »Latest Thoughts

Mini-Mobile And Mini-Minimalist. 2 Permian Frac Sand Growth Projects Could Be Online Imminently [Exclusive]

There is talk in frac sand inner circles this week about two capacity additions we’ve previously written about. Feels like these may becoming reality now… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be …

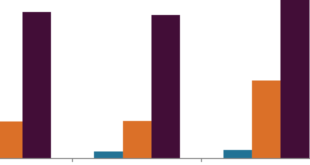

Read More »Analyzing The Nat Gas E&P Wallet – Spending Trends And Projections [Chart Of The Day]

Historical and projected spending trends in natural gas basins… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, please email …

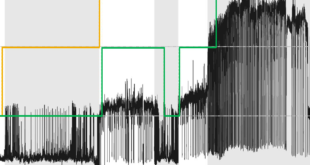

Read More »What’s Left In The Tank For The Rest Of The Year For Oily E&Ps? Quite A Bit Actually… [Chart Of The Day]

Want to know what to expect for the rest of the year in the US onshore oilfield? This data-driven update is a must read… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a …

Read More »Drilling Trends North Of The Border – Our Quarterly Glance At The Canadian Rig Market

As bad as things have been in the US drilling market, Canada has been a real slog this year. In this update, we provide a short briefing on trends there and what could come next… There’s a lot more to this story… Login to see the full update… To read …

Read More »Sand Customers Talk Supply Chain – From Damp Sand To AI To Bundling, Proppant Type, Volume/Well & More…

When frac customers talk, we listen. And here’s what we are hearing about their frac supply chains… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill …

Read More »Frac Customer Update Roundup – Fleets, Stages, OFS Pricing, Rigs, DUCs & More…

Here is the straight skinny on what’s going on with the D&C programs for 27 operators. One thing that stands out is the common focus on… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must …

Read More »Compare And Contrast – Sales Trends For The Bankrupt Proppant Providers

Who is taking market share during bankruptcy? Here are some clues… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, …

Read More »The E&P Emissions Conversation Heats Up… Oilfield Opportunity To Pounce On? [Chart Of The Day]

And the big buzzword in E&P this earning season is….??? There’s several, but… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership …

Read More »The Beginning Of An Asymmetric Frac Sand Mining Recovery?

3Q20 was an up quarter sequentially in the proppant industry. We estimate demand increased x-x% from the 2Q20 bottom. But not all mines are sharing equally as volume edges upwards off the bottom… There’s a lot more to this story… Login to see the full update… To read this update …

Read More »ESG Rigs – A Chat With The CEO Behind The World’s First Hybrid Rig

After writing about so called “ESG land drilling rigs” several times in recent rig count updates, we had a chance to catch up with a pioneer at the cutting edge of the ESG rig technological push this week. Here’s what we learned… There’s a lot more to this story… Login …

Read More »Wellsite Storage Market Commentary From A Silo Provider

Our quick takeaways relevant to the broader frac supply chain market from… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has …

Read More »US Silica’s Latest Frac Sand Market Outlook

In this update, you’ll find key takeaways relevant to the broader frac supply chain marketplace. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or …

Read More »Reading Between The Lines For The Pressure Pumping Market Outlook

On Wednesday, two pressure pumpers talked with investors about their market outlook and current activity levels. Reading between the lines and screening out the marketing and financial details, here are… There’s a lot more to this story… Login to see the full update… To read this update and receive our …

Read More »Liberty Responds (Indirectly) To A Peer’s Sweeping Supply Chain Reform With Their Own View On The Topic

An interesting conversation was had on Liberty’s earnings conference call this week that is directly related to a recent Infill Thinking exclusive report. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. …

Read More »In Other News… Merger Monday, Permian Weather, Nat Gas Bull Rush, Hydrogen Hype, & HAL “Dips A Toenail” In Renewables…

In addition to the in-depth updates published so far during this week in the frac life, these quick hits also crossed our desk and are worthy of a mention… There’s a lot more to this story… Login to see the full update… To read this update and receive our research …

Read More »Haynesville Local Sand Industry Pulls Ahead Of Its Westerly Neighbor [Chart Of The Day]

Going through local sand mine operating data for 3Q20 this week, a notable bifurcation stands out. Specifically… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill …

Read More »Buzz Builds Around “ESG-Rigs”

A couple weeks ago, Infill Thinking published an update on grid-powered rigs picking up steam as operators seek to cut emissions. Subsequently, the topic became a central point of interest during…. There’s a lot more to this story… Login to see the full update… To read this update and receive …

Read More »BIG Change Arrives In A BIG Frac Supply Chain? [Exclusive]

There is ample talk in the frac market this week about a potential deal with big implications for the oilfield value chain… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If …

Read More »Universal Pressure Pumping’s Frac Outlook

Universal’s parent company talked about the outlook for the frac business today… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has …

Read More »In The Best Week For US Drilling Since January 2020, The Gains Came From Some Surprising Places

The US land rig count had one of its best weeks of the year this week for change, adding 13 rigs (best week since January). Interestingly, the gains didn’t come from the typical places… There’s a lot more to this story… Login to see the full update… To read this …

Read More »E&P Consolidation Trend Kicking Into High Gear? Big Operator Rollups Left & Right Since July….

Yes folks, it’s true… what you’ve heard…. the oilfield marketplace is a changing and the competitive landscape we’ve all gotten used to for the past decade or so could look very very VERY different a decade from now… There’s a lot more to this story… Login to see the full …

Read More »Halliburton’s Lower 48 Frac Outlook

Halliburton hosted their 3Q20 earnings call on Monday morning and here are the takeaways that matter for folks in the frac business… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If …

Read More »New Last Mile Gear Goes Live In The Permian Basin [Photos And Analysis]

A new and improved wellsite storage system has deployed in the Midland Basin… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership …

Read More »One Last Quarter Where Schlumberger’s Earnings Report Still Matters To The US Frac Market

This morning, Schlumberger kicked off 3Q20 earnings season in the oilfield marketplace… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has …

Read More »Analyzing Covia’s Latest Financial Projections

A clearer picture begins to emerge about what Covia’s capital structure and financial statements will look like post-Chapter 11… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new …

Read More »2 “Can’t Miss” Permian E&P Developments…

In the past 24 hours, two new E&P datapoints that are important for the frac supply chain to take note of: There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you …

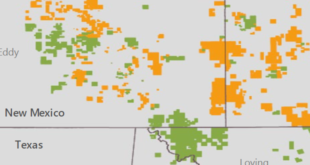

Read More »How Does In-Basin Sand Supply Distribution Line Up With Completions At The Bottom? [Chart Of The Day]

With US onshore activity limping up from the bottom of a harsh downturn, we asked the question – how well did the frac sand industry do in matching supply to demand regionally? We all know that sand producers…. There’s a lot more to this story… Login to see the full …

Read More »Grid-Powered Rigs Set To Gain Steam In The Next US Onshore Upcycle

There’s been a great deal of talk about e-frac fleets for several years, but what about drilling rigs moving to alternative power sources like grid-derived utility provided electricity as their primary power source? This is a trend that started prior to the downturn, and adoption is likely to become more …

Read More »Top Ten 3Q20 Updates

With 3Q20 earnings season commencing for the oilfield this week (Schlumberger reports on 10/16/2020), we too are taking a look back at 3Q20 performance here at Infill Thinking. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, …

Read More »Four Frac Folks On The Move….

A few frac folks on the move this week… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, please email …

Read More »The Wall Street Journal Just Wrote Frac Sand’s Obituary. Here’s Our Take, A Palate Cleanser & A Pick-Me-Up…

This week, the esteemed Wall Street Journal went to town on frac sand, all but declaring the sector dead. The piece has some elements that we commonly find in anti-O&G hit pieces, but it is more a diatribe describing the industry’s economic trials and tribulations than any thing else. The …

Read More »Where To Next For Frac Sand? Will The Industry Ever Be Able To Extract Itself From This Mess?

The frac sand business finds itself between a rock and hard place these days. The rock is extreme… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new …

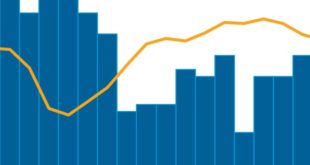

Read More »The One Chart That Says It All About US Frac Sand Supply/Demand

What a wild crazy insane ride the past five years have been in frac sand. This chart pretty much sums it up folks (click the chart to see it full size in a new window). Chart is followed by a couple observations… There’s a lot more to this story… Login …

Read More »Haynesville Strength Spotlight After Industry Talk Of An Uptick

Talk amongst our Haynesville friends about Louisiana fracs picking up a little steam over the past several weeks inspired this week’s rig count update. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be …

Read More »In Other News… Water Midstream Deals, 2021 E&P Capex Anxiety, Last Mile Contests & A Big Win? Hat Tip To One Of Our Own, & More…

In addition to the in-depth updates published during another interesting week in the frac life, these quick hits also crossed our desk and are worthy of a mention… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, …

Read More »Bankruptcy Bulletin – Summary Of Notable Developments In New And Old Cases In The Oilpatch…

In this update, we start with the new bankruptcies of the week before covering notable developments in several ongoing cases in the frac sand space. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be …

Read More »Bankruptcy In July Won’t Stop A Pumper From Rolling Out A New Frac Fleet By December…

Some things never change, and the persistent propensity to overbuild in the frac industry at large will outlive this Chapter 11 era. Twice last week… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be …

Read More »Visualizing Lower 48 Drilling Footprint Evolution

In this week’s rig count update, we thought we’d put the spotlight on geo-region shifts in drilling activity as the rig count has undergone a massive compression since year-end 2018. How has the market share of various basins fared during the rig count carnage? There’s a lot more to this …

Read More »Buyer Behavior Cliff Notes As Devon & WPX Become One Frac Customer

The Devon / WPX deal continues the theme of Lower 48 E&P consolidation and creates the fourth largest unconventional oil producer in the US (only behind Oxy, Conoco and EOG). In the sections below, we provide some customer behavior context for the Devon / WPX merger – viewing the big …

Read More »The Re-bundling Revolution [Friday Guest Post]

We are honored to carry this very important post from a supply chain strategist at one of the top three pressure pumpers in the US on a potential change in the oilfield marketplace – rebundling in the frac supply chain… There’s a lot more to this story… Login to see …

Read More »Something Notable On The Mobile-Mini Plant Front

Prior to the March 2020 oilfield crash, the in-field frac sand mining trend was poised for take-off, but the downturn obviously derailed this. Now this week…. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must …

Read More »Hunch Confirmed… NOV SandBank Bound For Vaca Muerta

On September 16, Infill Thinking covered the deployment of an NOV SandBank system, writing that the system could be headed to Argentina’s Vaca Muerta Shale. At the time, the destination had not been publicized by the players involved and the origin was an Eagle Ford yard. Now about a week …

Read More »A Half Dozen Frac People On The Move

Individuals are often overlooked in this asset-intensive sector, but talent shifts can have big implications for value creation, oilfield trends, sales and competitive dynamics. People on the move also have implications for how business is conducted across the frac value chain. Here are some moves that matter… There’s a lot …

Read More »Interesting Trend Budding In Eagle Ford Data

In this week’s US drilling trends update, we shine a spotlight on… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has …

Read More »A Penny On The Dollar For NWS Investments Gone Bad

A long-marketed Northern White Sand asset package finally found a buyer last week…. for what we estimate is a penny on the dollar relative to invested capital. This deal… There’s a lot more to this story… Login to see the full update… To read this update and receive our research …

Read More »Ranking The Basins By 2021 Sentiment On The Completions Outlook [Thoughts & Chart Of The Day]

Relative to the lows of 2Q20, which basin will enjoy the best trends after the ball drops on a miserable 2020 and 2021 completions programs start to kick in? Over the past couple of weeks, we’ve touched base with a whole bunch of industry contacts in the process of…. There’s …

Read More »Can The Federal Government Help Lessen Oil & Gas Volatility? Do We Want Them To? [Friday Guest Post]

I consider myself fortunate to have gotten to know Brent Halldorson, a tenured oilfield water expert, over the past couple of years. He’s a passionate student of our industry. About this time last year, I was in a conference hall listening to him speak on the history of the produced …

Read More »Two Years Post-Commercialization, A New Last Mile Solution Rolls Out… But Where To? Here’s A Hunch…

An interesting development in the last mile caught our attention this week… here’s what we know and what we are looking into… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If …

Read More »Frac Sand Bankruptcy Monitor – 2 Notable New Developments

Two new developments crossed the transom in ongoing frac sand restructuring cases that are worth a mention over the past week or so…. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve