Want to make a big splash at the next industry conference? How about announce that you are doubling the size of your company’s operations and tripling the basins you work in? That’s effectively what Black Mountain Sand did at the Permian conference in Fort Worth yesterday. As the dust settles …

Read More »Latest Thoughts

Synergizing Our San Antonio Site Visit Takeaways With Recent Emerge Energy Services Commentary

In April 2018, Infill Thinking’s research team had an opportunity to visit the new Emerge Energy Services plant in San Antonio and meet one-on-one with management to learn about operations there. Then in early-May, the company hosted their 1Q18 conference call. Blending what we learned from these two sources results …

Read More »As First Reported Here, Black Mountain DID Announce New Eagle Ford And Mid-Con Expansion Plans Wednesday Morning

This is a developing story, check back for updates… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, please email …

Read More »Joining The Greenfield Band: In-Basin Sand Has Recruited More Basins [Chart Of The Day]

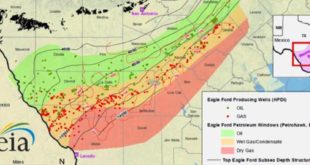

The Permian is the epicenter of the in-basin frac sand trend. Local sand sourcing is a trend that will be on display in full force in Ft Worth this week as upstream executives gather to talk all things Permian. But the magnitude of the trend’s reach into other geo-markets is …

Read More »10 Talking Points Sure To Surface Over Coffee & Cocktails In Fort Worth This Week

Many of our subscribers have descended upon Fort Worth this week for the large Permian Basin executive confab going on there. We’ve prepared the following “cheat sheet” of talking points in advance of the event. We tried to go a layer deeper than the agenda in this exercise, focusing on …

Read More »Three Rig Contractors Drill More Than Half The Laterals You Frac [Charts]

In this week’s rig count update we take a look at who is drilling wells in the US with a market share pie chart and the trend over time. There’s a lot more to this story… Login to see the full update… To read this update and receive our research …

Read More »Operators Concentrate On Cycle Times As Some Zipper Fracs Save Over A Million Bucks Per Well

2018 is the year of the zipper frac. Reducing completion cycle times is a key overriding theme in shale. Zipper frac are expanding both in use and definition. Check out how this trend is impacting completion programs in this update. There’s a lot more to this story… Login to see …

Read More »In-Basin Mines To Supply 75% Of Permian Basin Proppant Demand Next Year [Chart Of The Day]

Following up on our plant-by-plant review of Permian Basin frac sand production last week, we’ve also updated our estimates for the play’s frac sand demand broken down by supply source. In this update, you’ll see the chart and a bullet point list of our latest thoughts as we look at …

Read More »Mark Papa Says Shale Pundit Projections Fail To Account For Parent-Child Well Issues [Frac Hit Fear Index Update]

If you came for Mark’s quote, it’s further down along with other recent operator remarks on frac hits and parent-child well production impacts. First, a brief word on the industry’s general tone on parent-child wells and what it means for oilfield service companies after digesting a large batch of recent …

Read More »How Important Is The Battle For Mind Share In Oilfield Services, And More Specifically In Sand And Logistics? [New Discussion Forum Thread]

There is a new discussion topic over in our members-only Thinking Aloud forum. In it we discuss the importance of branding, marketing, and the mind share battle in oilfield services. In frac sand and logistics, this has been an afterthought in the past. But now a confluence of new factors …

Read More »Permian In-Basin Sand Production Blossoms In May 2018. Here Are Plant-By-Plant Updates

Six weeks ago, we assessed Permian in-basin frac sand production at an annualized rate of 15mmtpa coming from 7 operational facilities. This week, we updated our assessment, finding that local sand production has increased significantly in the past six weeks. In fact, daily local proppant availability is up X%, with the …

Read More »Differentials Be Darned. Permian Permits Pick-Up Anyway

Each week we cover a topical US weekly drilling trend, and provide in-depth analysis of the rig count and frac spread count. Here is this week’s installment… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you …

Read More »The Petition To List The Dunes Sagebrush Lizard As Endangered Is Live. So What, And What Next?

After the Dunes Sagebrush Lizard (DSL) petition was filed earlier this week, we had a chance to catch up with a subject matter expert on Texas environmental issues to learn a bit more about what matters in the petition and what to watch for next… There’s a lot more to this …

Read More »Frac Water Market Takeaways From The Select Energy Services Conference Call… [Live Blog Complete]

Live takeaways from Select’s 1Q18 earnings call… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, please email us to …

Read More »Making A Mountain Out Of A Molehill? Permian Producers Downplay Pipeline Impact On Their Completion Programs

With the Midland crude basis differential widening to as much as $15/bbl, we’ve received inbound questions from quite a few supply chain subscribers (and Bloomberg News too) asking about the impact on oilfield service activity and logistics. Here is an executive summary of the Permian producers’ view, our view, and …

Read More »Putting The Genie Back In The Bottle: Will The Frac Supply Chain Ever Be Rebundled? [New Discussion Topic]

Unbundling is trending in the US completions supply chain. So… a key question we’ve been asked by investors in the space recently is what might compel E&P buyers to rebundle their frac supply chains? In other words, can Big OFS put the genie back in the bottle now that it’s …

Read More »Today Is DSL D-Day

It’s official. We discuss… this is a developing story and we’ll be adding updates to this post as we learn more today. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If …

Read More »Infill Thinking Goes To Washington

At Infill Thinking, we are honored by a recent invitation to participate in this week’s Industrial Minerals Association North America Spring 2018 meeting. On Wednesday May 9, Infill Thinking Founder and Principal Research Analyst Joseph Triepke will speak about big picture frac sand market trends as a participant on the …

Read More »Preferred Sands Now Has A Double-Barrel Plant Strategy Lined Up In All The Big 3 Tight Oil Basins. Eagle Ford Site #2 Is The Latest News…

Get the latest on Preferred Sands’ multi-barrel approach to adding frac sand capacity in the big oil plays. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to …

Read More »US Land Drilling Breaks Through The 1,000-Rig Barrier. How High Can Rig Count Go?

This is the latest edition of our regular weekly rig count update filled with charts and analysis on North America onshore drilling trends. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. …

Read More »From What We Are Hearing, This Would Be A Great Weekend To Revisit This In-Depth Petition Primer…

Admittedly, predicting the timing of the DSL listing petition has proven difficult. That said, we suggest readers revisit this in-depth guide over the weekend to be braced for come what may… There’s a lot more to this story… Login to see the full update… To read this update and …

Read More »During Our Twin Eagle Site Visit In South Texas, We Learned About A Strategic Pivot To Adapt To In-Basin Sand

Several weeks ago, Infill Thinking’s research team had an opportunity to visit the Twin Eagle Mission Park transload terminal near Elmendorf, Texas. In this post, check out our drone photos and key takeaways on Twin Eagle operations and their latest developments including an important strategic shift. There’s a lot more …

Read More »A Regional Frac Sand Player Has Permitted Their Second STACK/SCOOP Mine

We’ve uncovered another newbuild frac sand mine project in the Mid-Con, which is now the focus of an intense land-grab similar to what played out in the Permian and Eagle Ford over the past 12-18 months, but admittedly on a smaller scale. There’s a lot more to this story… Login …

Read More »Hi-Crush Says Unbundled E&Ps Buy 33% Of Their Total Volume [5 Conference Call Bullet Points]

On Tuesday, Wednesday, and Thursday, three large frac sand companies hosted 1Q18 conference calls. Because most Infill Thinkers are too busy to study everything said, we are boiling down each call into a handful of key points that really matter. Here are the Hi-Crush bullet points, stay tuned for Emerge Energy …

Read More »It’s Official: Fairmount Santrol Confirms A Past Infill Thinking Report On Oklahoma Greenfield Expansion

Infill Thinking subscribers knew about the news that Fairmount announced today several weeks ago thanks to an Infill Thinking open records request and a little elbow grease we put into connecting some dots in the public record. There’s a lot more to this story… Login to see the full update… …

Read More »In Other News… More W TX Derailments, Selling The Dunes, Trucking Midland Crude, And A Long-Haul Rate Double

In “things that crossed our desk but didn’t qualify for a stand-alone update” over the past couple of days, we offer the following four datapoints of interest, intrigue, and impact: There’s a lot more to this story… Login to see the full update… To read this update and receive our …

Read More »FTS Int’l Says Frac Market Is Ebbing Not Flowing, Confirms Last Mile Conversion Datapoint [Live Blog Complete]

We live-blogged the FTS International conference call this morning, listening for oilfield marketplace implications (not so much financials or FTSI idiosyncratic issues). There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If …

Read More »Vista’s Eagle Ford Transload Is Breaking Throughput Records In Early-2018 [Site Visit Thoughts & Pictures]

Several weeks ago, Infill Thinking’s research team had an opportunity to visit the Vista Proppants and Logistics transload terminal near Dilley, Texas. Here are our key takeaways from our firsthand look at this facility. There’s a lot more to this story… Login to see the full update… To read this …

Read More »A Self-Proclaimed “Sand Snob” Laughed At The Regional Sourcing Trend Six Months Ago. He’s Not Laughing Anymore…

The customer is always right, and here is what they are saying about the frac sand they are buying. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new …

Read More »US Land Rig Dayrates Are Trending Higher For Super-Spec Equipment

Last week, three large land drilling contractors hosted quarterly conference calls. Their pricing commentary was an echo chamber of positivity, which is not terribly surprising with $68 WTI and the US onshore rig count moving up in 12 out of the 17 weeks so far this year. There’s a lot …

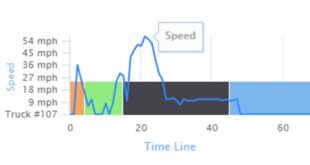

Read More »Automatize Takes An “Airbnb” Style Approach To Last Mile Logistics [Silica Valley Series]

This is the third installment in our Silica Valley Series which shines the spotlight on an increasingly critical part of the frac value chain: new software solutions in the last mile. A crop of new entrants are improving the frac sand industry’s “mind-muscle connection” on the highways from origin to …

Read More »Unbundled E&Ps Now Consume More Than A Quarter Of US Frac Sand [Operator List & Demand Estimates]

In this data-intensive report in our Out Think series, we take an in-depth look at the growing trend of direct sourcing and frac supply chain unbundling. In This Report You Will See: Why More Operators Are Moving To Self-Sourcing A List Of Which Operators Are Self-Sourcing How Much Sand They …

Read More »Permian Frac Sand Truck Demand And 6 Factors That Could Reduce The Need [Chart Of The Day]

So how many trucks will West Texas frac sand require in the last mile? We have estimates… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to …

Read More »US Silica Explains Permian Plant Delays, Says One Big Customer Has Switched Back To NWS [Live Blog Complete]

We live blogged our takeaways from the US Silica earnings conference call on Tuesday morning… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, …

Read More »Halliburton Issues A Rebuttal And An Endorsement

No EPS or EBITDA or financial speak to give you tired-head. Just the market intel that really matters curated from Halliburton’s earnings conference call on Monday April 23. Oh and also the fireworks… lots of fireworks. There’s a lot more to this story… Login to see the full update… To …

Read More »The New Face Of Frac Sand? Permian Startups Take The House Floor In Austin [Testimony Recap]

Last Wednesday, Hayden Gillespie (Chief Commercial Officer of Black Mountain Sand) and Bud Brigham (Chairman of Atlas Sand) testified in front of the Texas House Of Representatives Energy Committee. If you missed their testimony, no worries took it in and recapped the highlights here. Some interesting market intel and perspective on …

Read More »Spinning The Globe: A Glance At Drilling Trends Beyond The US…

On the heels of some market commentary provided by Schlumberger this week and some interesting headlines from around the globe, we examine the outlook for international drilling activity and dissect the international rig count. There’s a lot more to this story… Login to see the full update… To read this …

Read More »PropX: 6,000 Boxes And Counting

PropX is growing and they are growing fast. In this update, read exclusive details we learned in a recent meeting with management about the company’s build cadence, trends in box per crew, business model, adoption rates, and the impacts of steel tariffs and OSHA regs. There’s a lot more to …

Read More »Soft Prices & Oversupply In Pressure Pumping Are Pushing Schlumberger’s Frac Reactivation Plan To The Right

Oilfield earnings season kicked off Friday morning as Schlumberger discussed the outlook. No EPS here, just the important market points Big Blue made about business conditions in North America. There’s a lot more to this story… Login to see the full update… To read this update and receive our research …

Read More »Is Dewey County Becoming The “Winkler County” Of The Mid-Con? Another Mine Plan Is Found…

Yesterday’s wildfire news caused us to revisit publicly available mine permit records for the Mid-Con. We have uncovered an additional large-scale sand mining plan in Oklahoma as the Mid-Con proppant market appears to be quickly moving in the direction of the Permian – becoming locally supplied. There’s a lot more …

Read More »Train Wreck In Monahans Overnight Wednesday Is Tightening Things In The Permian Even Further

A Monahans train wreck overnight on Wednesday could impact Permian completions. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, …

Read More »STACK Threat Level Falling From The Oklahoma Wildfires That Raged Near Rigs & Greenfield Mines This Week

Thoughts on the developing wildfire situation in the Mid-Con as it pertains to upstream activity. This is a fluid situation, and we’ll be adding updates to this post as events unfold. There’s a lot more to this story… Login to see the full update… To read this update and …

Read More »If Not Rail, Then Barge. Unanticipated Logistics Havoc Is Plaguing 2018 Completions More Than Anticipated Trucking Issues

Everyone’s been focused on trucking in Texas. And trucking in Texas is tight. But it’s the devil you don’t know that’ll get you. And during the first half of 2018, unanticipated disruptions in transportation modes not involving wheels have wreaked much more havoc in the shale frac sand transportation network. …

Read More »Haynesville Shale Rigs vs. Mines [Maps And Charts]

Following this recent update on more local proppant capacity in the Haynesville shale, we received some inbound reader questions about the status of the Haynesville shale market. Incoming intel requests spanned both the frac sand market and general drilling and completion activity in the region. So we made some calls …

Read More »Eagle Ford Notes From The Road: Another Lizard, More Mines, Road Damage, Silo Repairs, Coarse Demand, And More…

This month in South Texas, we spent the better part of a week meeting with industry contacts, touring facilities, and combing the field for interesting angles. In this update, we’ve distilled our yellow pad full of random notes into the following digestible bullet points. Please stay tuned for several more …

Read More »Haynesville Shale Market Thoughts

Following this recent update on more local proppant capacity in the Haynesville shale, we received some inbound reader questions about the status of this regional market. Incoming intel requests spanned both the frac sand market and general drilling and completion activity in the region. So we made some calls and …

Read More »Korean OCTG Anti-Dumping Ruling Lacks Bite. Boiling It All Down, Here Are The Policy Change Takeaways For Buyers And Sellers

Policy whiplash continues in OCTG, but it appears to be about done now. With quotas and tariffs now seemingly set, the OCTG market can finally begin plotting its own course this year. We add up the pros and cons from recent policy changes from both buyer and seller perspectives. …

Read More »Sand Tiger Is Taming The Last Mile Beast One Truckload At A Time [Silica Valley Series]

In the Silica Valley Series introduction, we noted that commercialization models vary pretty widely in the digital last mile space. Sand Tiger, the second software in our series, is quite a bit different from most in that it was built and developed by a trucking operations company with no intention to monetize …

Read More »Permian Dune Sand Spot Price Check Up

This week, we worked our channels to check on the latest pricing for in-basin frac sand. Our last price check was during our February trip to the Permian, and earnings season is now just a couple weeks out. So it seems like a good time for a pricing update. Log …

Read More »Go Big Or Go Home… Haynesville New Entrant Is Preparing To Supply Half The Gas Shale’s Proppant Demand With Local Sand

We learned that the leading Haynesville frac sand new entrant’s ambitions have grown since our last conversation with the company in 4Q18. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve