The US onshore rig count increased another 19 rigs to 689 running last week. All of this activity coming back means rigs are being moved out of the yards and into the field. This creates a veritable boom for rig movers. We uncovered some proprietary market intelligence on rig moves …

Read More »Latest Thoughts

What Labor Loss? So Far Re-Hiring Concerns Seem Overblown

In the US onshore market, skilled workers are returning to the oilfield jobs they were doing a couple years ago en masse. We talked to a drilling consultant in West Texas this week who has been filling his days with dirt work during the downturn. He just got called back …

Read More »I’ll Take The Worst Neighborhoods In O&G For $200, Alex

The hardest sell in the entire O&G industry right now is without question a newbuild offshore rig order. Demand for offshore newbuilds is actually negative. Contractors continue to push out delivery dates, in some cases paying up to avoid taking delivery. With little visibility on a recovery, shipyards are being forced to …

Read More »Reports From Big Sand Are Still A Few Weeks Out, So Here Are Three Datapoints To Tide You Over

The big public frac sand suppliers (companies like Hi-Crush, US Silica, Fairmount Santrol, and Smart Sand) will be closely watched when they report earnings this quarter. Expectations for increased proppant demand are high as the US shale industry gets back to work. But Big Sand won’t be talking about their own …

Read More »Patterson-UTI Drops The Good News We’ve Been Waiting To Hear

One month ago, we wrote in an update to Infill Thinking subscribers that Patterson-UTI was likely to pre-announce better than expected results for 4Q16. Late Monday afternoon, the company did exactly that. Patterson-UTI said in a pre-announcement that its sales during the past quarter were 7% higher than analysts have …

Read More »Halliburton Is Reactivating Frac Spreads For A Pretty Penny

Halliburton’s strategy for 2017 is shifting, and the company will have a whole different M.O. this year. Jeff Miller, Halliburton President expressed his feelings about the new year this way: “in many ways, 2016 was like a bar room brawl where everyone, and I mean everyone, took a punch. But …

Read More »It’s A Good But Tricky Place In The Cycle For Oilfield Service Pricing

Oilfield service pricing moving higher cyclically is a good thing for all our readers (including operators, for current pricing is unsustainable and will destroy capacity in the long run). That said, we stand at a tricky juncture in the cycle for oilfield service company decision makers trying to reset their …

Read More »As 2017 E&P Budgets Kick In, Permian Rig Count Sizzles

After a brush back in the second week of the year, the US land rig count surged ahead last week. 2017 E&P budgets and drilling programs are kicking in and we expect continued strength over the next 4-6 weeks. Take out a free trial below to see our full analysis of …

Read More »Unintended Consequences – The Crude Price Risk Factor No One Is Talking About… Yet

Here at Infill Thinking, we don’t forecast the price of oil – we focus on oilfield activity, markets, and companies. But we do regularly talk to some of the best crude oil minds in the business. When they share noteworthy observations, we pass them along. So when one of these …

Read More »Schlumberger Restores Its Focus On The Pursuit Of Growth… Outside The US Too

This morning, Schlumberger management hosted a conference call with analysts to discuss 4Q16 results and the 2017 outlook. The company kicked off oilfield service earnings season on a positive note. Following nine consecutive quarters of relentless workforce reductions, cost cutting, and restructuring efforts, Schlumberger is restoring focus on the pursuit …

Read More »FRAC Inauguration – Wall Street Loving Keane Group’s IPO In Early Action

The big to-do in Washington today isn’t the only inauguration going today. In New York, the markets inaugurated Keane Group Inc. as the newest publicly traded frac outfit today. In this update, we discuss the IPO’s early performance and introduce the newest public frac company. There’s a lot more to this story… …

Read More »8 Quick Trends To Listen For During Oilfield Service Conference Calls This Earnings Season

Schlumberger kicks off 4Q earnings season this week, hosting a conference call Friday morning to discuss the 2017 outlook. During the fourth quarter, a cyclical inflection point materialized in the US onshore market. A key question during the calls this earnings season will be how sustainable the cyclical growth trajectory …

Read More »OFS Contractors Should Cheer Noble Energy’s Acquisition Of Clayton Williams

Permian oilfield service and drilling contractors are having one great start to the year. Contractors got another dose of good news yesterday as Noble Energy expanded in the Permian Basin with the acquisition of Clayton Williams. In this update, we discuss why the deal is good for oilfield service contractors …

Read More »Those Who Cut The Deepest Will Staff Up The Quickest [2 Charts]

In the first months of the downturn, we began warning that a workforce designed for $100 oil is not the same one needed at $50 oil. However, the oilfield service industry right sized extremely quickly to lower activity levels over the past two years. We’ll soon see just how surgical these cuts …

Read More »Sometimes You Need To Take A Breather

Nothing can go up and to the right forever, especially not the rig count. The US onshore rig count fell back by six units this week. This break is actually a good thing and we explain why and break down the weekly rig count in in this post. There’s a …

Read More »Another Day, Another Permian Deal

WPX Energy joined in the Permian deal making fray, announcing a $775mm Delaware Basin acquisition late Thursday. 2017 operating plan announcements from Permian Independents aren’t the standard fare this year. We are used beginning of year E&P operating plans stating capex, production, and drilling program summaries. This year they are …

Read More »Five Innovation Themes In Completions For 2017

In a related update published last week, we described how the brute force enterprise of nano-darcy E&P is becoming more elegant. Elegance is achieved as sub-surface understanding moves closer to a realistic picture of the reservoir. Enhancing sub-surface understanding is where leading innovators in shale are focused today. They are …

Read More »Two Operators Mashed Their Gas Pedals In The Permian This Week [Bullet Points]

News from Parsley Energy and SM Energy on Tuesday continued the Great Permian Migration trend this week. We break down the news into the most important incremental bullet points and provide a few words on the bigger picture trend in the Permian. By the way, if you are looking to …

Read More »One Of Our Buyers Makes A Deal

Last week we published a list of four companies we expect to make oil service acquisitions during 2017. Apparently grass isn’t growing under our buyers feet – less than a week after our preview, one of them has already made a purchase. There’s a lot more to this story… Login to see …

Read More »5 Questions We Hope Weatherford’s New CEO Answers On February 2nd

On February 2, Weatherford’s new CEO Krishna Shivram will talk to investors for the first time as the boss of the company. He’s got some work to do. The market will be looking for a restoration of confidence. That means Krishna needs to have a story for the new Weatherford …

Read More »What Does It Cost To Run A Rig These Days? We’ve Got Charts…

Another week of US onshore rig count gains is in the books. But before we quantify that in our weekly statistical update (see full update below), the other side of the equation deserves a few words. Everyone is focused on rising rig counts today. Tomorrow they’ll be focused on dayrates. And …

Read More »Read The Controversial Permian Basin Survey That Is Raising Eyebrows

We don’t normally republish articles from third party sources in full. But an in depth survey on the state of the Permian released at the end of last year is making the rounds this week. And if you haven’t seen it yet, it is definitely worth taking a look. Runaway …

Read More »Four Likely Buyers In Oilfield Service For 2017

In E&P, most analysts expect M&A action to be hot and heavy during the first half of 2017. There is less consensus about a wave of M&A coming in oilfield service (OFS), partly because of challenging valuations. So we put pen to paper this week and came up with the …

Read More »E&P In A Nano-Darcy World – A Brute Force Enterprise Finding Elegance

On a conference call in 2011, the always eloquent Clay Williams of National Oilwell Varco (then CFO, now CEO) said: The unconventional shale model is utterly unlike drilling a generation ago, which saw fleeting glimpses of precious darcy reservoir rock here or there, elusive four-way closure, a rare and fortuitous geologic …

Read More »The Great Permian Migration Continues With SM Energy Deal

The shale industry kicked off the new year with a continuation of the great migration to the Permian Basin. This morning SM Energy announced the sale of its third party operated assets in the Eagle Ford, including its ownership interest in related midstream assets, for $800 million. In this update we …

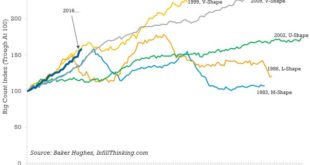

Read More »A December To Remember – The Biggest US Drilling Gain In Three Decades

US land drillers sent 2016 packing with a bang. Since May, the drilling recovery has looked exceptionally strong on a percentage basis. The December trend looked exceptionally strong on an absolute basis too with 65 US rigs returning to work. December 2016 delivered the best absolute rig count increase of …

Read More »Shale Executive Sentiment Index Surges Up To Levels Last Seen At $100 Oil

Two years into the downturn and at oil prices just half of prior highs, the US tight oil industry has begun to stage a recovery. We’ve all seen this new optimism in the tangible data. Rig count, capex, headcount, frac utilization – these are just a few of the US …

Read More »2016 US Land Rig Retirements Slowed Rapidly And Other Highlights From NOV’s Rig Census

Each winter, we look forward to unwrapping the annual rig census report released by National Oilwell Varco. With it’s uniquely comprehensive rig market history, the report provides good perspective on the competitive landscape for drilling rigs around the world. There were no surprises on the demand side this year – …

Read More »A Key Difference In The Industry’s 2nd BOP Outsourcing Deal Makes It Transformative

It’s fair to say that the blow out preventer (BOP) business model is being re-shaped as we write. 10 months ago, GE and Diamond introduced a new BOP arrangement to the marketplace – one that transfers up-time responsibility to the OEM. This week, the largest BOP supplier moved to implement …

Read More »Here Come The Guidance Raises In Oilfield Services

In an interim update posted this morning, oilfield chemical supplier Flotek positively revised its outlook to account for a more constructive US drilling and completions market as 2016 winds down. Last week we wrote about how the consensus 4Q slump is a no show this year. Flotek’s announcement provides confirmation and …

Read More »The Sharpest Drilling Rebound In US History Is Happening Right Now

The US land drilling market is exiting the worst downturn in history. Why not follow that with the sharpest rebound ever? That is exactly what is happening now. Since bottoming about 30 weeks ago, the US rig count has increased 60%. The 1985 recovery outpaced this one for 25 weeks before falling back. The only …

Read More »The O&G Job Creation Engine Is Firing Again

In the US, the O&G industry has begun to hire staff again for the first time in two years. We snapped this encouraging photo in front of a Halliburton completions yard while touring the Permian Basin in early-December. Source: InfillThinking.com Given what we know about the ongoing recovery and a …

Read More »FRAC IPOs Return… Literally. Meet The Next Public Completions Outfit

Frac IPOs are back. We mean that literally because the company about to make its public debut will trade under the ticker FRAC. This week, Keane Group Inc., owner of the 7th largest US frac fleet and employer of 1,251, filed an S-1 for a potential IPO. The company is …

Read More »Joy To The Oil & Gas World

This holiday season is the most jolly in years for the oil and gas business. It finally feels like the tide is turning on many fronts. One Year Ago, We Predicted Everything Would Bottom In 2016 Exactly one year ago, we wrote the following outlook for another shop: As realists, we have …

Read More »As The Fed Climbs Out Of The Interest Rate Crevasse, O&G Implications Are Mixed

The Fed raised interest rates for the second time in a decade on Wednesday. The Federal Open Market Committee raised its target range by a quarter point to 0.5% – 0.75%. The committee also expects to make three rate hikes in 2017, two or three in 2018 and three in 2019. …

Read More »In Offshore Drilling, Financial Restructuring Quietly Chugs Along As Noble And Shell Arrive At New Terms

Even when offshore drillers aren’t tapping the capital markets for debt or equity, financial restructuring is quietly continuing behind the scenes. Contractual terms continue to be renegotiated with customers, and price concessions are still being given. Literally hundreds of multi-year contracts that were in effect this time two years ago have …

Read More »A Deal Before Year-End: Patterson-UTI Pays Top Dollar For Seventy Seven Energy

Land drilling / pressure pumping hybrids Patterson-UTI and Seventy Seven Energy have agreed to join forces as 2016 draws to a close. Patterson-UTI will purchase Seventy Seven Energy for $1.76bn in an all-stock deal that includes the assumption and repayment of $336mm of net debt. This deal isn’t a bargain, as …

Read More »Gathering Steam In Early-2017 – Here Are Four Oil Service Choke Points To Watch

If OPEC’s November 30th decision to cut production was like adding tinder to smoldering embers, then progress made over this past weekend was like dumping gasoline on the fire. Lower 48 oilfield activity will gather steam (and quickly) in early-2017. As the upstream supply chain tightens early in the new year, …

Read More »What Fourth Quarter Slump?

Back in October, the North American land market was bracing for a seasonal slowdown into year-end. Here’s the warning Halliburton CEO Dave Lesar issued on a conference call about 6 weeks ago: “Based on current customer feedback we remain cautious around customer activity due to holiday and seasonal weather-related downtime. Our customers …

Read More »Chevron’s 2017 Capex Budget Is Up 45% In The Permian, But Down Most Everywhere Else

Compared to PDC Energy’s budget release earlier this week, Chevron’s 2017 continuing budget cuts are a stark reminder of the divergence theme we first wrote about in early-November. That said, these budget cuts are impacting most every area except one, the Permian. We break down the majors budget for subscribers …

Read More »The Pipe Dream Is Real. A New OCTG Business Model Is Trending In Shale

In US onshore markets, pipe has long been approached as a cumbersome consumable by the E&P industry. Suppliers haven’t historically provided much hand holding along to go with tubes sold, and many operators have found themselves practically in the pipe business themselves. In the conventional model, operators are invoiced when …

Read More »The Tenaris Midland Service Center Is Not Just Another Pipe Yard

We visited the sprawling $36mm Tenaris Midland Service Center this week. From this new Permian Basin facility, Tenaris is introducing Rig Direct™ to the US shale plays. Here Tenaris is running OCTG (casing and tubing), sucker rods, coiled tubing, and accessories in 24/7 operations. The Midland Service Center is the …

Read More »A New West Texas Yard Binds An Operator And Supplier Together For Decades

Pioneer Natural Resources is known for progressive thinking on partnerships. The company’s effluent water deal with the City of Odessa is a good example of how the company builds novel relationships to drive costs down. So when Tenaris proposed an unusual alliance around shared yard space, Pioneer listened. The end …

Read More »Atwood’s Drillship Mortgages Are An Industry First

Offshore drilling contractors have been signing deals with shipyards to delay taking rig delivery for several years now. With no visibility on work, it’s better to leave rigs on the docks where they took shape than to store them somewhere harsher. This morning Atwood announced a delay deal on a pair of …

Read More »‘Now Hiring’ Signs Return As The Permian Prepares For A 2017 Hockey Stick

We are in Midland/Odessa this week for meetings and site visits. The vibe here now is very different from our last visit 10 months ago. There is more field traffic on I-20, parking lots are fuller, and there is a stirring in the yards. In this post we discuss firsthand intel from …

Read More »The First Independent E&P Budget Released Since OPEC’s Cut Is Aggressive

PDC Energy is out with their 2017 spending program Monday morning, the first budget we’ve seen released since OPEC announced a production cut last week and sent crude oil prices up 10%. It doesn’t disappoint. We delve into the details and warn why readers should not extrapolate the percentage increase …

Read More »Great Minds Think Alike – The Story Behind The Infill Thinking Logo

Although not everyone is happy about it, we think Chesapeake’s new logo looks pretty good. Actually, really good. As reported by The Oklahoman last week, the company is rolling out a re-brand starting in January 2017, reflecting their evolution from ambitious young natural gas company (remember the blue flame in the …

Read More »On OPEC Day, US Operators Focused On Making Better Wells Instead

While the rest of the world focused on OPEC on November 30, US operators were focused on making their tight oil wells more effective with cutting edge innovation. We spent OPEC day in Houston with 35 senior US completions executives at the Darcy Completions Forum, squarely focused on emerging technologies …

Read More »The New Weatherford CEO Won’t Frac For Free. So Will He Take One Million Horsepower Off The Market?

The new Weatherford CEO is reportedly in the process of undoing his predecessor’s hydraulic fracturing business plan. If what we’ve been told by industry contacts is true, Krishna Shivram (pictured left) is throttling back frac operations in dramatic fashion. This would be the second big move he’s made in three weeks at the …

Read More »BJ’s Back As Goldman Sachs Buys Frac For Pennies On The Dollar

BJ Services returned to the scene as a standalone company late Tuesday as Baker Hughes announced the pressure pumping divestiture they talked about before the GE deal and confirmed during the GE announcement. We break down the deal including observations about value, Goldman Sach’s interesting history with BJ Services, and some …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve