Following the logic on M&A possibly returning in frac sand… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, please …

Read More »Produced Water Risks & Opportunities Abound As Deal Flow Increases [OWC Event Takeaways]

Last week, we joined 175 senior oilfield water industry professionals at the 3rd Annual Oilfield Water Industry Update conference at the Houstonian. It was a full house and a full discussion – there is no shortage of excitement in the sector at present. Here are some key takeaways from the …

Read More »E&P Consolidation Trend Kicking Into High Gear? Big Operator Rollups Left & Right Since July….

Yes folks, it’s true… what you’ve heard…. the oilfield marketplace is a changing and the competitive landscape we’ve all gotten used to for the past decade or so could look very very VERY different a decade from now… There’s a lot more to this story… Login to see the full …

Read More »A Penny On The Dollar For NWS Investments Gone Bad

A long-marketed Northern White Sand asset package finally found a buyer last week…. for what we estimate is a penny on the dollar relative to invested capital. This deal… There’s a lot more to this story… Login to see the full update… To read this update and receive our research …

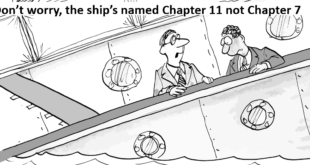

Read More »The Bankrupting Of Oilfield Service [Chart Of The Day]

Unsurprisingly, lawyers and restructuring advisors are the biggest winners in this mess. They are making out like bandits and harvesting a massive payday from the industry’s financial predicament. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, …

Read More »Mass Bankruptcy. What Does It Mean For “The 3 C’s” Of Oilfield Service?

It seems like every couple days another oilfield company declares Chapter 11. Against this bankruptcy backdrop, we consider the future of oilfield services… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. …

Read More »Situational Awareness – 7 Short Briefs On Distressed Frac Sand Company Happenings

The future of the frac supply chain’s competitive landscape is being rapidly reshaped by restructuring activity. Maintaining situational awareness in multiple fast-moving cases is key. And this week… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, …

Read More »Frac Sand’s Biggest Name From The Northern White Era Files Chapter 11 And Abandons Thousands Of Rail Cars

This is a firm we’ve flagged as a potential restructuring candidate in several recent posts (most prominently in a newsletter last week when we wrote “all eyes turn to Covia to see if they announce restructuring”). Today, we provide analysis of the news… There’s a lot more to this story… …

Read More »Oilfield Water M&A Charts Suddenly Awash In White Space [Charts Of The Day]

Like with most sectors of the US economy in the Covid-19 world, dealmaking has gone silent in the oilfield water sector. There are three reasons that the recent lack of transactions in this oilfield niche is especially noteworthy: … There’s a lot more to this story… Login to see the …

Read More »Graphing Oilfield Water M&A While Waiting For Deal Flow To Pick Up Again [H2O Chart Of The Day]

While waiting for deal flow to pick back up, we dusted off our water M&A database this week. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve