Each winter, we look forward to unwrapping the annual rig census report released by National Oilwell Varco. With it’s uniquely comprehensive rig market history, the report provides good perspective on the competitive landscape for drilling rigs around the world. There were no surprises on the demand side this year – …

Read More »A Key Difference In The Industry’s 2nd BOP Outsourcing Deal Makes It Transformative

It’s fair to say that the blow out preventer (BOP) business model is being re-shaped as we write. 10 months ago, GE and Diamond introduced a new BOP arrangement to the marketplace – one that transfers up-time responsibility to the OEM. This week, the largest BOP supplier moved to implement …

Read More »Here Come The Guidance Raises In Oilfield Services

In an interim update posted this morning, oilfield chemical supplier Flotek positively revised its outlook to account for a more constructive US drilling and completions market as 2016 winds down. Last week we wrote about how the consensus 4Q slump is a no show this year. Flotek’s announcement provides confirmation and …

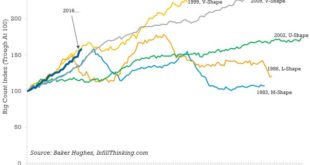

Read More »The Sharpest Drilling Rebound In US History Is Happening Right Now

The US land drilling market is exiting the worst downturn in history. Why not follow that with the sharpest rebound ever? That is exactly what is happening now. Since bottoming about 30 weeks ago, the US rig count has increased 60%. The 1985 recovery outpaced this one for 25 weeks before falling back. The only …

Read More »The O&G Job Creation Engine Is Firing Again

In the US, the O&G industry has begun to hire staff again for the first time in two years. We snapped this encouraging photo in front of a Halliburton completions yard while touring the Permian Basin in early-December. Source: InfillThinking.com Given what we know about the ongoing recovery and a …

Read More »As The Fed Climbs Out Of The Interest Rate Crevasse, O&G Implications Are Mixed

The Fed raised interest rates for the second time in a decade on Wednesday. The Federal Open Market Committee raised its target range by a quarter point to 0.5% – 0.75%. The committee also expects to make three rate hikes in 2017, two or three in 2018 and three in 2019. …

Read More »Chevron’s 2017 Capex Budget Is Up 45% In The Permian, But Down Most Everywhere Else

Compared to PDC Energy’s budget release earlier this week, Chevron’s 2017 continuing budget cuts are a stark reminder of the divergence theme we first wrote about in early-November. That said, these budget cuts are impacting most every area except one, the Permian. We break down the majors budget for subscribers …

Read More »Atwood’s Drillship Mortgages Are An Industry First

Offshore drilling contractors have been signing deals with shipyards to delay taking rig delivery for several years now. With no visibility on work, it’s better to leave rigs on the docks where they took shape than to store them somewhere harsher. This morning Atwood announced a delay deal on a pair of …

Read More »‘Now Hiring’ Signs Return As The Permian Prepares For A 2017 Hockey Stick

We are in Midland/Odessa this week for meetings and site visits. The vibe here now is very different from our last visit 10 months ago. There is more field traffic on I-20, parking lots are fuller, and there is a stirring in the yards. In this post we discuss firsthand intel from …

Read More »There’s A New Anti-Frac Movement Brewing. It’s Leaders Are O&G Industry Insiders

Since inception, hydraulic fracturing and shale exploitation have been fraught with controversy. Initial opposition mostly came from the far left and environmentalists. So called “fracktivists” include bands of protesters, lobbyists pushing for regulation, and filmmakers documenting mythical terrors. These outsiders have presented challenges for the industry ranging from mild annoyances to outright banishment …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve