As last week wore on, we had hoped it would get better. It did not. We had also hoped that our initial concern expressed on Tuesday was overstated when we wrote then that the swiftest shale pullback in history could be imminent. It was not. As the week wore on, …

Read More »It’s The Most Wonderful Time… For Tight Oil E&Ps With Change In Their Pocket & Long-Term Vision

Looking at today’s depressed stock prices for tight oil operators and declining E&P activity trends, you’d never guess that this is actually a relatively wonderful time to be an E&P operator actively developing US tight oil resources. There’s a lot more to this story… Login to see the full update… …

Read More »In Other News… Appalachia Hibernation, Buy Orange Pumps!, Frac Shutdown, Death By 1,000 Cuts For Irrational Projections?, Mine Hit Piece, & More…

In addition to the in-depth updates published over the past week, these 11 “quick hit” datapoints also crossed our desk and are worthy of a mention… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must …

Read More »Putting Permian Frac Thirst Into Broader Lower 48 Context [Chart Of The Day]

We estimate fracing the arid Permian Basin in 2019 requires X times as much pre-frac water as the next busiest US unconventional basin. Here’s a visual and analysis… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, …

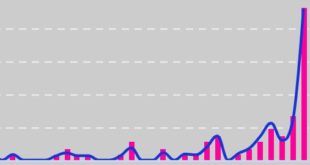

Read More »2018 Is The Greatest Growth Year In The Modern History Of The US Oil Business

We take a look at the drivers and stats on 2018’s banner year in the US onshore oil business. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new …

Read More »Mark Papa Says Shale Pundit Projections Fail To Account For Parent-Child Well Issues [Frac Hit Fear Index Update]

If you came for Mark’s quote, it’s further down along with other recent operator remarks on frac hits and parent-child well production impacts. First, a brief word on the industry’s general tone on parent-child wells and what it means for oilfield service companies after digesting a large batch of recent …

Read More »Frac Hit Fear Index And Parent/Child Interference In The Tight Oil Narrative

We devote a lot of bandwith to the most pressing concerns facing tight oil development here at Infill Thinking. In the long-run, other constraints rise on the horizon. These are the big picture sustainability sort of questions for tight oil development. In this post, we list these big picture issues …

Read More »Independent E&P Consolidation Is The Future. Is 2018 The Year? [Guest Post]

Experienced E&P strategist Paul Sparks has been thinking about the future of what today is a highly fragmented E&P industry. As the US unconventional business matures, will it always be run by 50+ public Independents and hundreds of smaller privates? Or is mass consolidation the future? History and some of …

Read More »Is It Really Different This Time? [Chart Of The Day]

We believe the recent surge of returns-focus rhetoric from E&Ps is having a considerable impact on consensus expectations for US shale E&P spending. This was evident in our recent survey, where participants expressed a bullish view on y/y oil price trends yet waxed conservative on the spending outlook. In this …

Read More »H&P Has Plenty Of 2018 Capex Budgeted To Upgrade Their 100+ Super-Spec Rig Candidates

Helmerich & Payne closed out C3Q17 earnings season for the land drillers late-last week. Here are the three statements that we found most interesting… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve