Everything seems lined up for an incredible 2H17 for US completion service providers. Everything except for oil prices. In a week of rampant pessimism, our obligatory negative post introduces several new developments you won’t read about anywhere else including what one of the biggest pressure pumpers in the market is telling …

Read More »DUCs Have Built A Nice Tailwind For 2H17 Frac Demand. The Permian Stands Head And Shoulders Above The Rest [6 Charts]

We don’t take the EIA data on completions and DUCs (drilled but uncompleted wells) at face value. But we do look at their work for directional trends on DUCs, which can be a good leading indicator for trends in frac horsepower demand. In this update, you’ll find our analysis of this week’s …

Read More »Frac Sand Is A Substitute For Wells And Rigs. Lower 48 Surface Sprawl Is Going Underground [Charts]

Is frac sand replacing rigs? It would appear so in the US onshore recovery. As unconventional drilling and completion science evolves, the industry’s surface footprint per barrel of oil produced is shrinking. A growing sub-surface footprint (which we can measure with sand) is replacing the surface sprawl. With the US onshore …

Read More »Infill Thinking Research Findings Are Making News Thursday Morning

In a feature story on Bloomberg News Thursday morning, several research updates issued by Infill Thinking recently are featured prominently. Check out Joe Carroll’s latest must-read below… Bloomberg No Description There’s a lot more to this story… Login to see the full update… To read this update and receive our research …

Read More »E&Ps Actually Underspent Budget In Every Major US Onshore Play During 1Q17

We actively monitor spending patterns for approximately 50 public independent operators. With virtually all of their 1Q17 results disclosed over the past week or two, we can now report some detailed insights on what their spending during the first quarter of the year means for the rest of 2017. There’s a lot …

Read More »Early Termination Switcheroo, Frac Hits, and Capex Clues… Here’s 10 Rubberneck-Worthy Developments From This Busy Week

With 27 oilfield earnings reports this week, including a dozen conference calls on Thursday alone, C-suites across the patch opened the information flood gates. We continue to pore over transcripts and 10-Qs. For this update, we are driving right on past the usual suspects. Laterals are getting longer, sand’s expensive and …

Read More »The US Onshore Rig Count Is Now Eclipsing Most Year-End Estimates, And It’s Barely 2Q

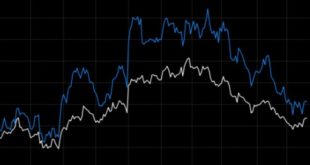

Last November before the OPEC meeting, we published a 2017 US land rig count forecast, which called for about 825 US land rigs working at year-end 2017. At the time, our forecast called for sharper growth during 1H17 than consensus expectations, with the pace of activity gains leveling off during 2H17. In this …

Read More »Schlumberger Doubles Down On North America, Absorbs Weatherford’s Frac Horsepower

Friday was a potentially transformative day for the US frac business. Not to be outdone by Halliburton’s big news Friday morning, Schlumberger and Weatherford dropped their own bombshell Friday evening. Schlumberger and Weatherford are combining their hydraulic fracturing businesses into a OneStim JV, which will be 70% owned by Schlumberger. …

Read More »As Wages Begin To Increase, Service Companies Have Another Reason To Raise Prices

Depending on the oilfield service or product line, we’ve heard of price increases of anywhere from 5% to 40% pushed through just in the past few months alone. As service companies look for new angles to justify higher list prices, they are increasingly pointing a finger at the labor pool. …

Read More »Capex Trends For Majors vs. Independents To Diverge In 2017, Except In Shale

BP and Shell updated their spending outlooks Tuesday morning. The two Majors echoed recent reports from their peers by again lowering planned capex spending. As Independents selectively spend a little more in 4Q16 and prepare to reverse their budget cuts next year, the Majors continue to systematically lower their total spend. Optically, …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve