Many of our subscribers have descended upon Fort Worth this week for the large Permian Basin executive confab going on there. We’ve prepared the following “cheat sheet” of talking points in advance of the event. We tried to go a layer deeper than the agenda in this exercise, focusing on …

Read More »The Petition To List The Dunes Sagebrush Lizard As Endangered Is Live. So What, And What Next?

After the Dunes Sagebrush Lizard (DSL) petition was filed earlier this week, we had a chance to catch up with a subject matter expert on Texas environmental issues to learn a bit more about what matters in the petition and what to watch for next… There’s a lot more to this …

Read More »Making A Mountain Out Of A Molehill? Permian Producers Downplay Pipeline Impact On Their Completion Programs

With the Midland crude basis differential widening to as much as $15/bbl, we’ve received inbound questions from quite a few supply chain subscribers (and Bloomberg News too) asking about the impact on oilfield service activity and logistics. Here is an executive summary of the Permian producers’ view, our view, and …

Read More »Putting The Genie Back In The Bottle: Will The Frac Supply Chain Ever Be Rebundled? [New Discussion Topic]

Unbundling is trending in the US completions supply chain. So… a key question we’ve been asked by investors in the space recently is what might compel E&P buyers to rebundle their frac supply chains? In other words, can Big OFS put the genie back in the bottle now that it’s …

Read More »From What We Are Hearing, This Would Be A Great Weekend To Revisit This In-Depth Petition Primer…

Admittedly, predicting the timing of the DSL listing petition has proven difficult. That said, we suggest readers revisit this in-depth guide over the weekend to be braced for come what may… There’s a lot more to this story… Login to see the full update… To read this update and …

Read More »A Self-Proclaimed “Sand Snob” Laughed At The Regional Sourcing Trend Six Months Ago. He’s Not Laughing Anymore…

The customer is always right, and here is what they are saying about the frac sand they are buying. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new …

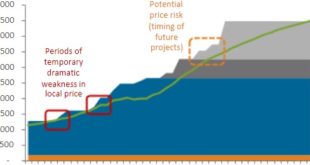

Read More »Midland WTI Spread Blowout Implications [New Discussion Thread]

There’s a new thread over in our members-only discussion forum. In it, Infill Thinkers are discussing the implications of takeaway constraints in the Permian and the recent widening of the Midland crude price differential. Read more and add your response here >> There’s a lot more to this story… Login …

Read More »No Listing Petition Yet, But Two Other Notable DSL Datapoints Have Crossed Our Desk

After publishing a “petition may be coming” piece last week, we talked to several more market participants who confirmed they expect action soon. Meanwhile, there have been a couple interesting developments that set the table for the legal battle whenever it begins. There’s a lot more to this story… Login …

Read More »Antero’s Frac Supply Chain Strategy Is Changing. Here’s What We Know And What We Think We Know

Antero made some interesting comments at an investor conference this week. We break down what you need to know about their frac supply chain here. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be …

Read More »Will We Look Back At The Concho / RSP Deal As The Start Of Tight Oil Consolidation? [New Discussion Thread]

There’s a new thread over in our members-only discussion forum. In it we question whether the big Permian M&A deal this week marks the start of a push for scale. There’s a lot more to this story… Login to see the full update… To read this update and receive our …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve