On Wednesday afternoon this week, we had a chance to touch base with ProFrac executives to learn about their ambitious 2018 growth plan. Infill Thinking spoke by phone with Ladd Wilks and Matt Wilks – Chief Executive Officer and Chief Financial Officer of ProFrac, respectively. Here’s what we learned… There’s a …

Read More »Land Drilling Rig Capex Is Sinking To New Multi-Decade Lows

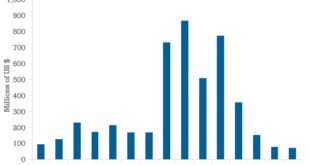

As E&P spending continues to recover, land driller spending looks poised to embark on a fourth straight year of decline. Precision Drilling released their 2018 capex program on Monday. We analyze the numbers in this update… There’s a lot more to this story… Login to see the full update… To …

Read More »The Results Of Infill Thinking’s 2018 Outlook Survey Are In…

Last week, we asked readers to answer 13 questions about the outlook for 2018. The focus of our survey was key trends and themes in the US onshore business. Participation was strong, with a diverse mix of respondents – all of whom are well informed on Lower 48 trends. In …

Read More »Reports Of Shale Investment Demise Are Greatly Exaggerated. Don’t Buy The Fake News Lifting Oil Prices… [Rebuttal]

Contrary to the click bait proliferating on other media platforms, US oil producers are not slashing 2017 tight oil investment programs as a result of recent crude oil price volatility. Anadarko’s US onshore investment revision, which became the poster child for so called shale budget cuts this week, is grossly misunderstood. Not only …

Read More »What’s Next For Devon After A Record-Setting STACK Well? Watch Showboat Spud [Follow The Leaders]

Record setting STACK well results announced by Devon on Tuesday morning bode well for what the operator has planned next – a transition to full field, multi-zone manufacturing starting at a nearby location. We share our cliff notes on Devon’s pivotal Showboat project, which spuds imminently. There’s a lot more …

Read More »Don’t Read Too Much Into The Two Artificial Lift Transactions This Week

On the same day this week, both Halliburton and Forum Energy Technologies made acquisitions in the artificial lift space. Specifically, each firm announced a deal to take out a privately held electric submersible pump (ESP) target. The coincidental timing and shared ESP focus of the deals has inspired some exaggerated …

Read More »The Top Infill Thinking Stories, Charts, And Debates Of 2Q17

Infill Thinking membership tripled over the past three months. Before we review 2Q17 research highlights, here is some color on readership. As of July 2017, Infill Thinking readership is comprised of analysts, business people, and executives categorized as follows: If you haven’t subscribed (or renewed your free trial yet), please …

Read More »Recent History Says US Rig Count Will Roll Over In August If Oil Falls Sub-$40

With oil prices falling, it is worth noting what historical oil price / rig count relationships suggest about future drilling activity. In this update, we examine the oilfield reaction times that can be expected when oil prices move. There’s a lot more to this story… Login to see the full …

Read More »How Far Can Shale Grow On Run Flat Tires?

E&P transcripts we’ve seen from recent investor conferences have been pretty upbeat all things considered. Why? Oil prices are sub-$45 and under pressure. Well, shale has some tricks up its sleeve that allow it to keep going, and we break them down here. There’s a lot more to this story… …

Read More »With US E&P Sentiment Hinging On $45 Crude, A Top Five Pressure Pumper Is Already Pulling Back

Everything seems lined up for an incredible 2H17 for US completion service providers. Everything except for oil prices. In a week of rampant pessimism, our obligatory negative post introduces several new developments you won’t read about anywhere else including what one of the biggest pressure pumpers in the market is telling …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve