A look at the production driver data for South Texas Sand plants… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has …

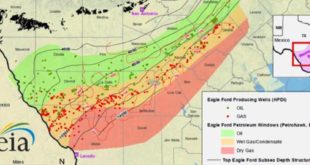

Read More »More Frac Sand Mines Enter The Eagle Ford Shale

We’ve identified new frac sand production facilities coming to market in the Eagle Ford… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or …

Read More »Takeaways From Industry Conversations In Fort Worth Today

This week, we attended the large oilfield conference in Ft Worth. We enjoyed seeing industry friends and here is some of what we heard… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a …

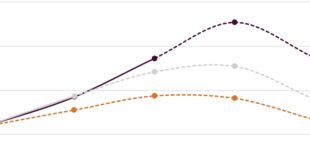

Read More »Shale E&P Capex Shape Curve Skews Front-End Loaded In 2023 [Chart Of The Day]

Thoughts on E&P spending for 2023… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, please email us to discuss …

Read More »A Super Major Would Still Add Permian Rigs & Frac Crews Over The Next Couple Years At $60 Oil

We digest big plans from a big E&P pertaining to the Permian into a digestible summary… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, …

Read More »March Madness – Frac Stocks Getting Crushed This Month [Chart Of The Day]

Thoughts on frac stock price performance… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, please email us to discuss …

Read More »Mapping The Public OFS Universe’s Customer Concentration From Disclosures

Thoughts on the importance of certain customers to certain OFS providers… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, …

Read More »Shale E&P Capex Is Coming In Hot [Chart Of The Day]

Thoughts on E&P spending for 2023… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, please email us to discuss …

Read More »Hindsight Is 2022! Grading Infill Thinking’s Frac Predictions From A Year Ago

One year ago, we made 10 predictions about 2022 in this update. In this “post mortem” report, we hold ourselves accountable for the hits and misses… how’d we do? Hint, if this were an exam in school, we’d have scored a 90%! There’s a lot more to this story… Login …

Read More »Super Majors Are Starting To Show Their Cards On Higher 2023 Shale Spending

Together we estimate Chevron and Exxon are running X frac crews and X rigs in the Lower 48. We dig into their budget and production outlooks given this week. There’s a lot more to this story… Login to see the full update… To read this update and receive our research …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve