Diamond Offshore was the first offshore driller to host its 4Q16 earnings conference call on Monday morning. In this post, we extract the most poignant statements management made on the call about the future of the offshore drilling business, identifying and corroborating some of the most important themes in the offshore …

Read More »Infill Thoughts

Weatherford’s New CEO Hit A Home Run. Weatherford Is Now The Biggest Turnaround Story In O&G

In his debut Thursday morning, Krishna’s clear and concise vision for the company’s future greatly impressed us. He knocked it out of the park and launched the biggest turnaround story in the industry. There’s a lot more to this story… Login to see the full update… To read this update …

Read More »Seadrill Bankrupt By February? Confidential Slide Deck Shows They May Take The Plunge…

A restructuring press release from Seadrill on Tuesday sent shares tumbling 29%. The press release said achieving viable restructuring would involve “significant dilution to current shareholders” and noted that the company needs a $1bn lifeline. In this context, down shares 29% is about right. But significant dilution to shareholders in a restructuring …

Read More »Weatherford’s New CEO Debuts Tomorrow – Food For Thought

On February 2, Weatherford’s new CEO Krishna Shivram will host his first earnings conference call as the boss of the company. This is a pivotal moment for the company. As Krishna unveils his strategic vision for the company tomorrow, he will usher in a new era, re-setting expectations for Weatherford for …

Read More »Halliburton Picks A Partner For The Last Mile Dance

Six weeks ago, we identified last mile logistics for frac sand as a potential choke point in the 2017 recovery. Frac sand’s last mile is a tedious dance between operators, trains, trucks, pumps and thousands of tons of sand. Halliburton validated our concerns on Monday evening. There’s a lot more to this …

Read More »Is Baker Hughes Over-Innovating?

Baker Hughes seems to be taking an assembly line approach to innovation, focusing on product launch volume as an important KPI. This is in stark contrast to Steve Jobs’ disruptive approach to innovation, where he would focus on a single game-changing idea for years at a time. We’ve recently become …

Read More »Time To Clear The Yards

The US onshore rig count increased another 19 rigs to 689 running last week. All of this activity coming back means rigs are being moved out of the yards and into the field. This creates a veritable boom for rig movers. We uncovered some proprietary market intelligence on rig moves …

Read More »What Labor Loss? So Far Re-Hiring Concerns Seem Overblown

In the US onshore market, skilled workers are returning to the oilfield jobs they were doing a couple years ago en masse. We talked to a drilling consultant in West Texas this week who has been filling his days with dirt work during the downturn. He just got called back …

Read More »I’ll Take The Worst Neighborhoods In O&G For $200, Alex

The hardest sell in the entire O&G industry right now is without question a newbuild offshore rig order. Demand for offshore newbuilds is actually negative. Contractors continue to push out delivery dates, in some cases paying up to avoid taking delivery. With little visibility on a recovery, shipyards are being forced to …

Read More »Reports From Big Sand Are Still A Few Weeks Out, So Here Are Three Datapoints To Tide You Over

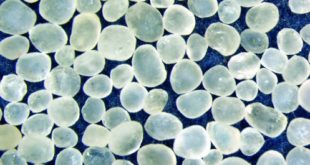

The big public frac sand suppliers (companies like Hi-Crush, US Silica, Fairmount Santrol, and Smart Sand) will be closely watched when they report earnings this quarter. Expectations for increased proppant demand are high as the US shale industry gets back to work. But Big Sand won’t be talking about their own …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve