An important E&P capex update this week reads distinctly negative for anyone hoping for an oilfield spending increase in 2020. Here’s the relevant excerpt: There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a …

Read More »Latest Thoughts

Be Thankful I Don’t Take It All ‘Cause I’m the Taxman [Friday Guest Post]

While you fight for the survival of your business, the assessor is doing his/her job and preparing notices of property assessments. Those assessment notices will reflect the idyllic conditions back on January 1, 2020. There’s a lot more to this story… Login to see the full update… To read this …

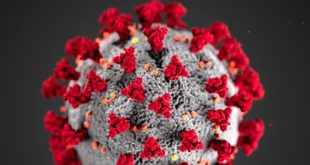

Read More »COVID-19 Blamed For Work Stoppages At Several Frac Jobs This Week [Exclusive]

Frac disruption and inefficiency is on the rise as workers show symptoms or test positive for COVID-19… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill …

Read More »Infill Thinking Offers Relief To Laid-off Members

Unfortunately, thousands of extremely talented and dedicated oilfield business people are being let go right now through no fault of their own. So this week, Infill Thinking will begin offering 90-days free access to any oilfield business people let go from their position in these uncertain times. By offering furloughed …

Read More »E&Ps Are Hardstopping US Oilfield Activity [Voice Of The Industry Survey From The Past 7 Surreal Days]

Here’s what we heard during phone calls with many of our oilfield contacts over the past 7 days: There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to …

Read More »The Leading US Land Rig Contractor Reacts As The Drilling Nosedive Begins

Friday March 20, 2020 is the day the land rig count collapse began. Last Friday, rig count was down 20 units with the Permian leading the way down (-10 rigs). Here’s what the market leader said in reaction to the beginning of this unprecedented crash…. There’s a lot more to …

Read More »Tallying Up The Known Frac Crew Releases For The Public E&Ps

There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, please email us to discuss our current subscription options at [email protected]. (Current …

Read More »Insuring The Frac Supply Chain’s Last Mile In A World Of Nuclear Verdicts And Vicarious Liability [Friday Guest Post]

Earlier this week, another trucking company’s nuclear verdict made headlines, this one outside of the frac sand hauling industry but notable none-the-less. While definitions can vary, a “nuclear verdict” is generally thought of as a jury award where the penalty exceeds $10 million. Nuclear verdicts have driven insurance premiums for …

Read More »For The US Land Rig Count, It’s The Calm Before The 100-Year Storm [Weekly Rig Count]

The Baker Hughes US land rig count on Friday (+3) did not yet reflect the releases that operators are planning. Calm before the storm? Here’s everyone that’s disclosed plans to release rigs…. There’s a lot more to this story… Login to see the full update… To read this update and …

Read More »Seems Impossible, But Things Got Worse Between Black Monday & Friday The Thirteenth [Notes From The Field]

As last week wore on, we had hoped it would get better. It did not. We had also hoped that our initial concern expressed on Tuesday was overstated when we wrote then that the swiftest shale pullback in history could be imminent. It was not. As the week wore on, …

Read More »Flu Fear On The Frac Site

If this virus can can shut down Major League Baseball and Disney Land, why should we expect that frac sites will be any different and stay open as virus reaction spreads? If this virus can empty dormitories because of spreading risk in close quarters, what about man camps? Here’s what …

Read More »Factoring 2020 DOT Drug & Alcohol Reg Changes Into Frac’s Last Mile [Friday Guest Post]

When Phil Baxter recently asked me if I had looked into the big changes that were made in January to the FMSCA’s drug and alcohol policies (and the impact they could have on hauling capacity in the frac supply chain), I perked up and asked if he’d chime in on …

Read More »NPR Marketplace Cites Infill Thinking’s ‘Double Black Swan’ Report In Coverage Of The Oil Price Fall-out

On March 9, 2020, National Public Radio’s Marketplace show aired a segment across >800 US radio stations about the oil price fall-out’s impact on US oilfield activity. Their piece draws insights from our research update published for Infill Thinking subscribers earlier that day titled “On Black Monday, A Double Black …

Read More »US Tight Oil E&Ps React Swiftly, Decisively To SLAM The Brakes

It’s been 36 hours since the oil industry’s D-Day equivalent, and US E&P operators are wasting no time cutting activity… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are …

Read More »The First Consolidation Deal In Oilfield Service Since Everything Changed Over The Weekend

There is one less independent wellsite storage firm operating in the Lower 48 today after a legal battle culminated in a takeover that will see the fleet change hands. There’s a lot more to this story… Login to see the full update… To read this update and receive our research …

Read More »On Black Monday, A Double Black Swan Leaves Us Staring Into A Black Abyss

“It’s always darkest before it goes completely black.” – Sen. John McCain We digest the implications of the market fallout and think through some things that matter for business leaders in the oilfield at its darkest hour… There’s a lot more to this story… Login to see the full update… …

Read More »Corona On Our Minds [Friday Guest Post]

Guest Contributor Introduction From Joseph Triepke: Today’s guest post has been three years in the making. Allow me to explain…. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are …

Read More »Don’t Conflate Exxon’s Big Permian Rig Count Chop With Completions [Analyst Day Takeaways]

Within minutes of the transcript of the Exxon analyst day being released, we shared this summary of what’s new in the company’s Permian Basin Drilling & Completion outlook…. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, …

Read More »A Brief History Of The Flaring Dialog Between E&P CEOs & Investors

In a separate update earlier this week, we quantified a new kind of flaring intensity index. Today we explore the qualitative side of this trend, distilling over 1,000 executive/investor conversations about flaring over the past decade and a half into this 5-minute-read summary. There’s a lot more to this story… …

Read More »The Customer Is Always Right, And Here Are The Most Notable Things Frac Sand Customers Said In February

EOG said recently that better pairing of origin and destination vs. 2019 will help them achieve targeted well cost savings. We wonder if this is simply better availability of local sand near their wells or possibly mobile mini plant adoption? Here is the key quote as well as other interesting …

Read More »Corona Quote Of The Day From An Energy CEO Who Believes People Are Overreacting

Here’s what one energy CEO very candidly told investors in Vail this week about how he thinks the broader public and O&G industry is overreacting to fear surrounding the coronavirus… There’s a lot more to this story… Login to see the full update… To read this update and receive our …

Read More »8 Frac People On The Move

We take a look at some notable comings and goings. The frac talent pool continues to play musical chairs. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new …

Read More »Flaring ‘Conversation’ Intensity Heats Up [Chart Of The Day]

In this update we study a different kind of flaring intensity – the flaring conversation intensity. This is not a new issue, but the conversation is heating up and evolving. There’s a lot more to this story… Login to see the full update… To read this update and receive our …

Read More »A Wellsite Storage System Provider Plays Offense – Calls Other New Gen Solutions “Outdated”

“We are signing up operators that want to move away from outdated and unsafe………….” That’s what one growing wellsite storage provider in the frac supply chain had to say about their wellsite storage solution displacing the competition on their conference call this week…. There’s a lot more to this story… …

Read More »What’s New On 6 E&P Water System Sale Processes, Plus A Handful Of Other Oilfield Water Market Datapoints

From the datapoint deluge this week, we’ve extracted these critical pieces of oilfield water market intelligence. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, …

Read More »US Oilfield RIF Tally Mounts [Chart Of The Day]

One week ago today, we quantified the reduction in force trend using 2019 headcount data from the 15 companies that had filed annual reports up to that point. Today, we’ve added another 22 companies that have released annual reports since then, and the number of jobs lost in US shale …

Read More »Large US Rig Contractor Says E&P Customers Plan To Keep The US 2020 Rig Count Flat vs. 2019

In this week’s regular rig count update, we take a look at what a large rig contractor said about customer plans… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you …

Read More »Three Firms Control About Half Of The Wellsite Storage Market. Here’s What They Had To Say About It.

Here are the key bits of market intel that we picked out remarks made by three market share leaders in the wellsite storage game last week… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must …

Read More »WaterBridge’s Buying Spree Extends Into 2020 As Another Large E&P System Is Divested

We take a look at WaterBridge’s acquisition history and comment on their latest deal in this update… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill …

Read More »Connecting The Dots On Last Week’s Wet Sand IP Claims Using Public Record

We did some digging after an E&P CEO’s damp sand frac patent claim last week sent a ripple through frac sand inner circles. Here is what we have uncovered… There’s a lot more to this story… Login to see the full update… To read this update and receive our research …

Read More »Sandemonium Update On The One Month Anniversary Of The Permian Sand Scramble

Last week, Hi-Crush said on their 4Q19 earnings call that January 2020 was the strongest month of sand sales in any January in company history. This datapoint is inline with our recent stream of reporting on stronger than expected frac activity – and sand demand – starting with this update …

Read More »E&P Operator Claims Wet Sand Patent & Royalties “If Others Want To Do It”, Presenting A New Risk For Mobile Mini Wet-Only Plants

A large E&P operator has firmly planted a legal flag of conceptual ownership in damp sand. This raises lots of questions for the broader adoption of the practice, including applications in in-field frac sand mining… There’s a lot more to this story… Login to see the full update… To read …

Read More »2019 RIFs Cut Deep And Devon, Solaris, and Patterson-UTI Cut The Deepest So Far On A % Basis [Chart Of The Day]

This earnings season, a morbid data set is emerging from the shadows and becoming visible. Everyone in the oilfield is well aware of the reduction in force (RIF) trend that swept across the US onshore oilfield last year and continues this year. But the true extent of the damage has …

Read More »Revealed: A Mobile Mini Plant Schematic & Equipment Photos

New pictures and a schematic have come to light as one of the first movers on the in-field mining trend continues making moves. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. …

Read More »Key Takeaways From Texas RRC Ryan Sitton’s First Natural Gas Flaring Report Release… [Live Blog Complete]

We live blogged our key takeaways from a critical TX RRC report release via webinar on Tuesday afternoon February 19, 2020… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you …

Read More »The Big Picture Themes That Matter Most In 2020 US E&P, Oilfield Water, Service And Sand Markets

Today we are giving readers a look behind the curtain at an important part of our research process. We’ve summarized the key themes we believe will be highly influential in shaping oilfield market fundamentals in 2020. Until now, these ideas have just lived on our whiteboard and post-it notes… There’s …

Read More »First (And Now Only) Utah Local Sand Project Crosses Into New Terrain

There are new developments today in the Uintah Basin local frac sand story. Our analysis of the new facts that have come to light can be found here… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, …

Read More »Not Dead Yet… The Beaten-Down Canadian Drilling Market Shows Signs Of Life

This week, we put a spotlight on drilling activity trends in the Canadian rig market… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or …

Read More »8 Things FTSI Said This Week That Advance The 2020 Frac Market Narrative

Listening to the FTSI call this week, here’s what stood out to us as far as market intel takeaways for the Lower 48 pressure pumping market… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must …

Read More »End Of Week Roundup: Flaring Crackdown Risk, Will Laredo Sell H2O System? Sand Unbundling & Use Spike, RIFs, EIA Forecast Fade, & A Little Friday Humor…

In addition to the other research we’ve posted this week, here’s an assortment of interesting odds and ends that crossed our desk and will be of interest to Infill Thinking members… There’s a lot more to this story… Login to see the full update… To read this update and receive …

Read More »Meet Another Leader In Frac Sand’s “In-Field Mine” Movement

This week, we had a chance to catch up with another mobile mini plant pioneer to learn about their approach. This is the third mobile mini plant provider we’ve profiled since writing a deep dive on the theme a month ago, which got folks talking and has drawn out new …

Read More »A Big Fade In Local Sand Mine Activity Late Last Year Set Up A Tighter 2020 Frac Sand Market [Sand Chart Of The Day]

With fewer greenfield projects actively under construction now than at any time in the past three years, we believe that nameplate capacity activations at large-scale fixed local frac sand plants are mostly in the rear-view mirror now. Here’s a data-driven assessment of local sand mine activity in the Lower 48, …

Read More »Graphing Oilfield Water M&A While Waiting For Deal Flow To Pick Up Again [H2O Chart Of The Day]

While waiting for deal flow to pick back up, we dusted off our water M&A database this week. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to …

Read More »An Eagle Ford Leading Indicator Surged In January – Positive For 2020 Frac Activity In South Texas

A look at a leading indicator in a key southwest market is the subject of this weekly rig count data spotlight.. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you …

Read More »“ESG Fleets,” Attrition Ends? A Major Stops Fracing, & A Newbuild Order… It’s Been An Exciting Week In The Pressure Pumping Market

This week, two large pressure pumpers hosted 4Q19 earnings calls. Here are our takeaways from their remarks as it pertains to the 2020 pressure pumping market… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, …

Read More »Oilfield Water M&A Deal News Slows In Early-2020. Why & What’s Next…

2019 was a record year for M&A deals in oilfield water. Will 2020 be able to keep up the pace? There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are …

Read More »The Permian Basin’s Snow Day – Implications & Pics From The Deep Freeze This Week

If you are at HFTC or NAPE in Houston this week instead of the Permian Basin, count your lucky stars. If you are in the Permian on Wednesday, there’s a high probability you are: a) trying to reschedule your trip (or your meetings) because all flights have been cancelled b) …

Read More »Green Light On Bakken Local Sand Project

In a meeting on Wednesday morning, county officials approved the latest… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, …

Read More »Hot On The Heels Of Hi-Crush’s Mobile-Mini Division Launch Comes Related News About A Potential Application

We are able to put some important context around the first newsbyte about Hi-Crush’s mobile mine solution beyond their official announcement about the new division launch last week. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, …

Read More »The Land Rig Leader Is Driving Commercial Model Change In US Contract Drilling

There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, please email us to discuss our current subscription options at [email protected]. (Current …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve