A powerful narrative shift is underway with big implications for U.S. oil and gas production, producers, and enablers… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, …

Read More »As WTI Trades Above $110/BBL (14-Year High!), A Salute To Shale & What Our Readers Do To Further Its Noble Cause…

The world is a mess. The tyranny of an evil man is on full display, disrupting world order, and it won’t be soon forgotten as an uncertain globe witnesses unprovoked civilian devastation from the biggest military action in Europe since WWII. The ripple effects could obviously be profound. As a …

Read More »Paper Trades Make Oil Prices Look Better Than They Are In The Physical Market… [Chart Of The Day]

Torn by two extreme market forces (oil demand destruction from the lockdown and geopolitical supplier actions), US oil prices are being distorted and dislocated beyond recognition. Here’s how the actual spot bids in the field are trending across various grades and basins (spoiler alert, it isn’t pretty and the lowest …

Read More »Iran’s Ill-Advised Attack On Saudi Was Actually A Gift To The Kingdom [Friday Follow-Up Guest Post]

The Friday before last week’s drone attacks on Saudi oil infrastructure that caused oil prices to momentarily spike, Bill Edwards wrote a guest post for Infill Thinking titled Historical Oil Price Perspective & A Sober Long-Term Outlook [Friday Guest Post]. The way oil has traded in the wake of the …

Read More »A Shot In The Arm, But The US Frac Supply Chain Still Needs Surgery

Sunday was not a day of rest for most folks who think about the oil and gas industry for a living. We’ve never seen so many weekend news updates and research notes hit our inbox, and for good reason. In the days (and possibly weeks) ahead, you will see countless …

Read More »Historical Oil Price Perspective & A Sober Long-Term Outlook [Friday Guest Post]

Here at Infill Thinking, we are humble oilfield service guys by trade not well heeled oil price pundits. That said, we regularly talk to some of the best crude oil minds in the business. When they share noteworthy observations, we pass them along. One such oil price expert we check …

Read More »Are West Texas Producers Unnecessarily Taking A $5/Barrel Hickey?

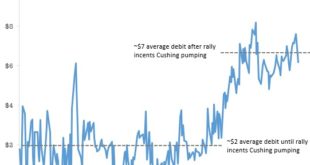

There’s a new reader-submitted post in our thinking aloud forum, please visit the thread here to read and discuss how (and potentially why) the oil price rally is masking some important disconnects. Emerging discounts are impacting tight oil producers who sell product based of WTI benchmarks, but it may not …

Read More »This OPEC “Production Cut” Is Really Just More Of The Same

OPEC’s announcement in Algeria of an agreement to curb production has the press excited about the “the first OPEC production cut in 8 years.” But we’d argue this is just more of the same as no member quotas have been set yet. We explore the details, nuances and implications here. …

Read More »The Savior Everyone Is Waiting For

The Barclays investor conference held in New York the week of Labor Day marks the start of the year-end news rush. A hot item at Barclays was a basic truth about the oil market: failing to offset natural declines will push oil prices higher every time. Today’s capex starvation is setting up tomorrow’s feast. There’s …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve