In addition to the in-depth updates published during another interesting week in the frac life, these 9 quick hits also crossed our desk and are worthy of a mention… There’s a lot more to this story… Login to see the full update… To read this update and receive our research …

Read More »Latest Thoughts

How Will The Liberty Deal Reverberate In The Frac Sand Value Chain? [A Special 3-Part Report]

Now that we’ve all had a couple days to process the biggest frac industry news in quite a while, what does the M&A transaction mean for the proppant supply chain? Specifically frac sand and last mile logistics pure-play vendors? We have some strategic recommendations and actionalbe analysis on the competition …

Read More »2021 Producer Perspectives – Peering Ahead As Operators Begin To Firm Up Next Year’s Business Plan

We hope everyone enjoyed the Labor Day holiday weekend despite the pandemic. For many oilfield business folks, this holiday traditionally marks the…. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If …

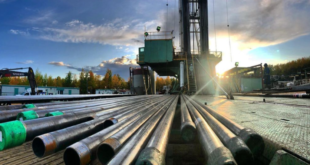

Read More »The Ins & Outs of OCTG Inventory in 2Q20 [Friday Guest Post]

Our Friday’s in September guest post series starts off with a bang today. We are always excited when Susan stops buy, and her data driven insight continues to shed light on an opaque oilfield niche market… There’s a lot more to this story… Login to see the full update… To …

Read More »Profit Center vs. Cost Center? This Deal’s Impact On Pricing + Unanswered Questions [Liberty Deal Analysis Part 3 Of 3]

Special Report From Our Analyst Plan Today we introduce a special three-part series unpacking the Liberty / Schlumberger M&A deal’s nuanced implications for frac’s critical path supply chain: proppant. Each installment offers in-depth analysis that can’t be found anywhere else, concluding with an executive summary of strategic recommendations and industry …

Read More »Direct Sourcing, Last Mile, & Wellsite Solution Implications [Liberty Deal Analysis Part 2 Of 3]

Special Report From Our Analyst Plan Today we introduce a special three-part series unpacking the Liberty / Schlumberger M&A deal’s nuanced implications for frac’s critical path supply chain: proppant. Each installment offers in-depth analysis that can’t be found anywhere else, concluding with an executive summary of strategic recommendations and industry …

Read More »Sand Mine Valuation Thoughts [Liberty Deal Analysis Part 1 Of 3]

Special Report From Our Analyst Plan Today we introduce a special three-part series unpacking the Liberty / Schlumberger M&A deal’s nuanced implications for frac’s critical path supply chain: proppant. Each installment offers in-depth analysis that can’t be found anywhere else, concluding with an executive summary of strategic recommendations and industry …

Read More »NWS Sand Plants Go On The Auction Block Thursday, And Bids Are VERY WEAK

Going once, going twice… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, please email us to discuss our current …

Read More »‘Project Stars’ Complete – Schlumberger’s Frac Team Hands Over The Keys To Liberty

As most readers know by now, Schlumberger sold their frac business to Liberty in a big deal announced this morning. The deal, code named “Project Stars” per the deck title, makes Liberty… There’s a lot more to this story… Login to see the full update… To read this update and …

Read More »Delaware Basin City Running Out Of Water – An Underappreciated Story With Big Implications

In today’s bizarre world, so called “social media influencers” get millions of views for videos containing meaningless blather. On the other hand, we dug up a video posted about a week ago which everyone in the Permian oilfield should watch with rapt attention; however, it only had 25 views as …

Read More »The Past 2 Weeks Don’t Make A Trend, But 2 More Will…

Are we there yet? To the bottom of the worst downturn ever? There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has …

Read More »In Other News… 4 Quick Hits From Frac Land

In addition to the in-depth updates published during another interesting week in the frac life, these quick hits also crossed our desk and are worthy of a mention… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, …

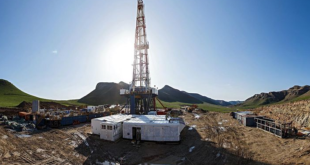

Read More »The Permian Frac Sand Market Could Get Interesting In 2021 [Chart Of The Day]

What does the future hold for the depressed local sand market out West? We blow the dust off our crystal ball and leverage some intel from our premium data service to try to provide some context here… There’s a lot more to this story… Login to see the full update… …

Read More »Not Something You See Every Day….

An interesting datapoint gives a new dimension to the whole boxes vs. silos debate. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your …

Read More »The Bankrupting Of Oilfield Service [Chart Of The Day]

Unsurprisingly, lawyers and restructuring advisors are the biggest winners in this mess. They are making out like bandits and harvesting a massive payday from the industry’s financial predicament. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, …

Read More »Mass Bankruptcy. What Does It Mean For “The 3 C’s” Of Oilfield Service?

It seems like every couple days another oilfield company declares Chapter 11. Against this bankruptcy backdrop, we consider the future of oilfield services… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. …

Read More »Where Exactly Are The First Signs Of Life Appearing In Rig Land?

Finally! Rigs are going back to work here and there… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, please …

Read More »Has Vista Averted A Ch. 7 Scenario? Oh, And Some Valuation Highlights Too….

Similar to another completions player a few days ago, another sand producer has come out with some revealing financial disclosures… And this one appears to have skirted a liquidation event. There’s a lot more to this story… Login to see the full update… To read this update and receive our …

Read More »7 Frac People On The Move

Individuals are often overlooked in this asset-intensive sector, but talent shifts can have big implications for value creation, oilfield trends, sales and competitive dynamics. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a …

Read More »Local Sand’s Best House In A Bad Neighborhood? [Chart Of The Day]

An important E&P capex update this week reads distinctly negative for anyone hoping for an oilfield spending increase in 2020. Here’s the relevant excerpt: There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a …

Read More »What Is Hi Crush Worth Liquidated? What Is It Worth As A Going Concern?

We dug and dug and dug… and we dug up some estimates… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has …

Read More »Not Much To See Here In Monday’s Frac Sand Bankruptcy Hearing

Quick notes from yet another… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, please email us to discuss our …

Read More »Round Trip – Here Are The Debts Poised To Be Erased By An E&P’s Second Bankruptcy Filing In Four Years

Here’s what we learned from a “repeat restructuring” E&P’s latest filings… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, …

Read More »Historical Context As The Rig Count Slide Continues

Rig count remains under pressure, slipping AGAIN this week, down five and now threatening to move down into the 220s next week. Here are two… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be …

Read More »A Different Data Angle To Quantify The Permian Frac Crash [Chart Of The Day]

In this update, we break down an obscure data set – a second order effect of the frac crash – to produce fresh insights on the depth and velocity of frac market contraction in West Texas… There’s a lot more to this story… Login to see the full update… To …

Read More »Situational Awareness – 7 Short Briefs On Distressed Frac Sand Company Happenings

The future of the frac supply chain’s competitive landscape is being rapidly reshaped by restructuring activity. Maintaining situational awareness in multiple fast-moving cases is key. And this week… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, …

Read More »Here Lizard Lizard Lizard… DSL Rears Its Head Again, This Time Factoring Into Permian Sand Bids

While the press always has a field day with the lizard headlines, oilfield customers are paying attention to listing and habitat exposure. And so we are too! Here’s what’s happening a level deeper than the media headlines in today’s oilfield marketplace… There’s a lot more to this story… Login to …

Read More »Drilling Market Share Changes From Top To Covid Bottom

This week we take stock of market share evolution in the US onshore drilling business during these crazy Covid times… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are …

Read More »A Cashless 2H20 Oilfield Bounce? [Charts Of The Day]

Lots of analysts, ourselves included, are writing about the uptick in completions and frac crew count. But let’s be careful not to put the cart before the horse… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, …

Read More »18 Frac People On The Move

We take a look at some notable comings and goings. The frac talent pool continues to play musical chairs. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new …

Read More »What The Customers Are Saying… About Frac Crews & DUCs

Being a great analyst starts with being a great listener. So we listened… and listened… and listened some more! And here’s what we learned about frac plans… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you …

Read More »What The Customers Are Saying… About Their Frac Sand

A great many analysts have opinions and prognostications. Forecasts for oilfield services are a dime a dozen. But who’s really listening to what your customers are saying? We are! And here’s what you should know about what they are telling investors about frac sand sourcing… There’s a lot more to …

Read More »What The Customers Are Saying… About Their Oilfield Water

A great many analysts have opinions and prognostications, which they broadcast loudly – predictions are a dime a dozen these days. Who’s really listening to what oilfield customers are saying? We are! And here’s what you should know about their oilfield water strategies… There’s a lot more to this story… …

Read More »Frac Focus – Pressure Pumping Market Color From 6 Firms That Control About 1/3rd Of The NAM Frac Market Today

What’s going on in the frac market, hhp trends, working crews, pumping hours etc etc? Read all about it here! There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are …

Read More »In March, Two Land Drillers Had More Active Rigs Than The Entire US Does Today & They Agree There Is Still Downside

In this week’s rig count update, we shine a spotlight on a squishy bottom and lack of visibility in the US land rig market where two contractors took a different tone to discussing the bottom than one of their peers’ bolder statement several days earlier… There’s a lot more to …

Read More »Still Some Work To Do, But Big 2Q20 Cuts Helped US E&Ps Get Back On Budget Track [Chart Of The Day]

Want to know what to expect for the rest of the year in the US onshore oilfield? This update is a must read… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. …

Read More »Solaris Estimates The US Frac Crew Count Can Rebound 35-45% In 3Q20

Solaris Oilfield Infrastructure hosted their 2Q20 call on Friday morning. On the call, we…. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your …

Read More »US Silica On Track To Harvest $27mm In Customer Shortfall Payments During 2Q20 and 3Q20

US Silica hosted their 2Q20 call this morning. One thing that… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, …

Read More »Judge BLASTS Sand Abandonment. Meanwhile, Landfilling Activity Implies Negative Value For Northern White Sand

Some surprising things came to light this week regarding NWS’s value (or lack thereof), railcar rejections and the general sand market in a bankruptcy hearing yesterday that was not short on fireworks… There’s a lot more to this story… Login to see the full update… To read this update and …

Read More »Foreclosure Sale At Big Last Mile Logistics Firm Will Likely Do Little More Than Change The Equity Structure

On Wednesday afternoon, several newspapers (including the Dallas Morning News and Houston Chronicle) ran a public notice regarding a foreclosure sale involving a large last mile logistics firm scheduled for mid-August. Here’s our understanding of this fluid situation… There’s a lot more to this story… Login to see the full …

Read More »The Most Important Thing To Watch This E&P Earnings Season If You Are An OFS Provider [Chart Of The Day]

With E&P earnings heating over the next 7-10 business days, one critical thing we’ll be watching closely is how…. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new …

Read More »Tallying Up The Damage As Another E&P From Our Bankruptcy Watchlist Files Chapter 11

Like many of the other filings in recent weeks, Rosehill was one of about 20 names on the Infill Thinking bankruptcy watchlist published in May 2020. Here’s a few things we learned in their filing… There’s a lot more to this story… Login to see the full update… To read …

Read More »TX Oilpatch Layoff Trends [Chart Of The Day]

This week, we updated our WARN notice chart, tracking oilfield mass layoff activity back to 2011. We noticed that… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new …

Read More »Permian Rig Count Ticks Higher For First Time Since March

Not going to make a big difference in anyone’s business, but it’s good to see… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or …

Read More »Brief Notes On The US Completion Outlook From Thoughts Shared By Three OFS Leaders This Week

Over the past couple of days, we heard from the management teams of Patterson-UTI, Schlumberger, and Core Lab. Here’s what’s… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are …

Read More »1/2 The Rail Cars That Used To Move NWS Are Now In Storage With More Piling Up By The Day…

Several interesting things came out of a rail company’s write off and disclosures yesterday and as it pertains to the frac supply chain… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. …

Read More »Not So Fast My Friend… Resistance To A Sand Producer’s Plan To Walk Away From Thousands Of Cars

A noteworthy point of contention in a big frac sand bankruptcy came to our attention this week… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill …

Read More »A Plan For Stranded Sand… Plus Some Eye Opening Frac Sand Financials

With multiple large scale frac sand producers in the relatively early stages of CH 11 bankruptcy proceedings, we spent Thursday morning combing through court records for new market datapoints. The search was fruitful… There’s a lot more to this story… Login to see the full update… To read this update …

Read More »Permian Rig Count Finding Firmer Ground

There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, or your membership has expired, please email us to discuss our current subscription options at [email protected]. (Current …

Read More »A Career First For Us ALL… Plus, Three More Bankruptcy Bullet Points

Back on March 9, 2020, we wrote in the last sentence of this update: There comes a point in every oilfield cycle where things get Darwinian, and in this downcycle, that time is now. We own our mistakes, and the above point missed the mark on two fronts: i) early timing, …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve