Since New Year’s Day, ~40 fresh IR decks have hit the wires from the O&G industry… and that doesn’t even include downstream or midstream. The presentation dump came ahead of the year’s first significant O&G investor conference this week. We have cherry-picked the following datapoints with 2018 implications from public …

Read More »Latest Thoughts

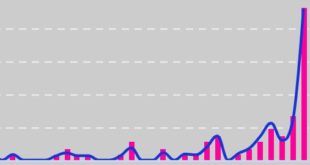

What’s Behind Your Blender? Introducing Well Site Frac Sand Handling Market Share Estimates

In the chart below, we’ve attempted to quantify a relatively opaque, highly competitive, and rapidly evolving last mile market segment – well-site frac sand handling and storage. As completion intensity exploded over the past few years, frac sand handling at the well-site just before it enters the blender and is …

Read More »A Chat With Capital Sand Permian About The New Frac Sand Plant Catching Some Folks By Surprise Today [Exclusive Interview With Company President]

News of another Permian frac sand plant is starting to make the rounds this week. We had a chance to catch up with the company’s president by phone to hear exclusive details about the growth plans. There’s a lot more to this story… Login to see the full update… To …

Read More »Land Drilling Market Share At The 2018 Starting Gun

In this update we take a look at market share among the leading land drilling contractors. Starting with winners and losers from 2017, we then look at present share and future market share strategies for the group. In what may be a flattish rig count environment in 2018, the …

Read More »Mapping The Dunes – 6 West Texas Frac Sand Plant Maps [PDF Download]

After recent requests from subscribers, we’ve refreshed several different looks at the West Texas frac sand scene. Subscribers are able to download maps in pdf form. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must …

Read More »Sand & Water Dual-Threat, Icy Permian, Atlas Funded, Rail Snafu, Snow Bomb Dud, And Other Interesting Datapoints To Start Your Year Off Right…

Well, the new year isn’t wasting any time pushing a steady stream of oilfield datapoints across our desk. Although we could easily write a full update on each of these, some of these items fall outside our typical research update scope. So we bundled the quick hits that we found …

Read More »$3.5 Billion Per Year. That’s How Much Cash Permian Dune Sand Could Save The US E&P Industry [Economic Impact Study]

A year from now, 20 new Permian frac sand mines could be operational if all build-out plans unfold as expected. Many risks linger in this story, particularly surety of supply at the wellhead and downhole performance. But let’s imagine for a moment a future world where the West Texas frac sand …

Read More »Don’t Read Too Much Into The Permian Rig Count Trajectory Lag. It Is Not A Sign Of Animal Spirit Inflection

We have seen some recent market commentary interpreting a lackluster Permian rig count response to the 4Q17 oil price rally as evidence of a change in E&P behavior or appetite for Permian development. We do not believe this interpretation is accurate. In this update, see what we believe are the real …

Read More »OneStim Is Just BlueStim Now – Weatherford/Schlumberger JV Breaks Up, Replaced With Outright Pressure Pumping Sale

The OneStim JV between Schlumberger and Weatherford contemplated in March of 2017 has broken apart. Instead, Weatherford sold off its idled pressure pumping business to Schlumberger. What does this mean for the players and the market? We have some thoughts here… There’s a lot more to this story… Login to …

Read More »Revisiting Silicosis Prevention Resources After The 2017 Permian Frac Sand Rush [Guest Post]

The explosion of new industrial (silica) sand mining and processing operations in west Texas suggests the need for a review of one of the oldest known occupational diseases, silicosis, and the strategies that sand mining and processing operations can adopt to prevent the development of silicosis among their respective employees. …

Read More »Twenty Questions Set The Tone For The 2018 US Oilfield Service Marketplace

We believe the following 20 questions encapsulate the transcendent themes facing the US oilfield service market during 2018. These are not in any particular order. We have included plenty of context and background for each question, but we stopped short of answering them. As the new year begins, so much can still …

Read More »‘Twas The Frac Before Christmas

Infill Thinking Holiday Cheer For Christmas 2017: http://www.infillthinking.com/wp-content/uploads/2017/12/Twas-the-Frac-Before-Christmas.mp3 Lyrics: ‘Twas the frac before Christmas, when all around the well Not a frac hand was stirring, or even a DSL; The frac sand was late, stored at transload with care, In hopes that a pneumatic trailer soon would be there. The …

Read More »One Million Frac Horsepower In 2018. That Is ProFrac’s Plan & We Caught Up With Management To Learn More

On Wednesday afternoon this week, we had a chance to touch base with ProFrac executives to learn about their ambitious 2018 growth plan. Infill Thinking spoke by phone with Ladd Wilks and Matt Wilks – Chief Executive Officer and Chief Financial Officer of ProFrac, respectively. Here’s what we learned… There’s a …

Read More »The Primary Vision Frac Spread Count Forecast For Early 2018 [Guest Post]

This year, we’ve found it helpful to keep an eye on the frac spread count (FSC) maintained by Primary Vision, Inc. So we called our friend Matt Johnson, a principal at the data firm that maintains the FSC, to learn more about how this metric came to be and the methodology behind …

Read More »The Top 10 Infill Thinking Updates Of 2017

Subscribers will relive a lively year of action by seeing the top research updates Infill Thinking published this year. We also revisit the amazing guest posts shared by 21 contributing subscribers this year. Our readers are the smartest in the business! There’s a lot more to this story… Login to …

Read More »Will The Change In The NYMEX WTI Spec Shut In Canadian Crude? [New Post In Our Thinking Aloud Forum]

Just a heads up that a new thread has been started by William Edwards over in the Infill Thinking discussion forum. In the thread, William thinks about how a recent change in the Cushing WTI specs will impact Canadian prices and ultimately world crude oil prices. Spoiler alert – it’s not …

Read More »Atlas Sand Unveils Permian Buildout Ambitions That Would Make Them The Largest US Frac Sand Producer By Today’s Standards

Big news in the Permian Basin local sands story from a player that has remained under the radar. This will have everyone talking today… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a …

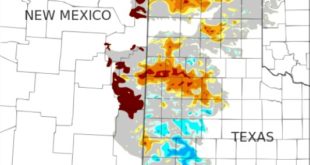

Read More »A Look Back At 2017 US Onshore Drilling Growth By Basin [Heatmap]

As the year draws to a close, here’s a look around the nation at the hottest onshore drilling basins and how they stack up this year on activity growth. Also included is a discussion of how the actual overall trend in US drilling compares to expectations a year ago and …

Read More »Monday Was EL’D-Day’ – A New Last Mile Logistics Era Has Begun

Well, after all the outcry leading up to mandate day, did anyone really expect a smooth start? On Monday December 18, soft enforcement of the new electronic logging device (ELD) rules began. We discuss what happened when shifts began in this new era and what it may mean for the …

Read More »Cattle Guards Cause Permian Sand Truck Traffic To Reroute

In July, we wrote about the risk of hidden delays for trucks carrying locally sourced frac sand from new plants direct to wells, noting that some challenges are impossible to understand by simply looking at a map. These are things like stop lights, rail crossings, road quality, school zones, left …

Read More »You Are What You Are… And The West Texas Oilpatch Is Very Thirsty [Analysis + Link Library]

Water sourcing comes up often in our conversations with all sorts of different Permian Basin oilfield participants these days. Extreme thirst is the tight oil industry’s open secret – sourcing is more opaque than supply chain elements like rigs, horsepower, pipe and sand. We quantify surging water use in West …

Read More »Independent E&P Consolidation Is The Future. Is 2018 The Year? [Guest Post]

Experienced E&P strategist Paul Sparks has been thinking about the future of what today is a highly fragmented E&P industry. As the US unconventional business matures, will it always be run by 50+ public Independents and hundreds of smaller privates? Or is mass consolidation the future? History and some of …

Read More »All I Want For Christmas Is A New Frac Spread

50% of the 70 industry respondents to our recent 2018 outlook survey predicted that the US frac spread count would return to the prior cyclical high (450) next year. In our analysis of the survey results, we noted that this development would require material frac horsepower newbuild orders to be placed. …

Read More »Founder’s Welcome To Our 1st & Only Sponsor: Westward Environmental

2017 was Infill Thinking’s first full year in business. Readership growth this year has far exceeded my initial expectations, and the Infill Thinking team is honored and grateful to have earned your trust in our market intel. This year, we turned down multiple requests from oilfield companies interested in advertising …

Read More »Unimin + Fairmount Santrol Becomes A Reality

Unimin and Fairmount Santrol have decided to combine in a merger expected to close mid-2018. The deal will create the largest frac sand supplier in the US. The merger of these two sand bellwethers has been rumored “seriously” since October and “casually” since well before that. In fact, back in …

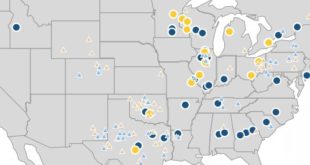

Read More »Ghosts Of Frac Sand Past, Present, And Future [Rigs vs. Mines Maps]

Since April, the geo-transformation of the frac sand business has accelerated. In the following charts, we’ve taken our previously published rigs vs. mines cartographical analysis a step further. In the slideshow below, we’ve included a map of historical frac sand supply sources, the new map with three West Texas in-basin …

Read More »Permian Frac Sand Suppliers Are Gathering This Week To Form An In-Basin Consortium [Exclusive]

On Wednesday, the fierce competition that has characterized the Permian Basin frac sand rush all year will be put on hold for a couple hours. We have exclusive details on why and what’s going on in this update… There’s a lot more to this story… Login to see the …

Read More »Our Problem Isn’t Oil Prices. It’s the Self-Inflicted Costs [Guest Post]

For more than two years, the North American Energy industry has struggled with low prices. Companies have idled workers and equipment, squeezed vendors, and taken additional cost cutting measures. But our problem isn’t oil prices. Rather, it’s the self-inflicted costs. There’s a lot more to this story… Login to …

Read More »The Independents May Intend To Temper Tight Oil Growth Next Year, But The Majors Sure Don’t…

On Tuesday, we warned that by taking their foot of the capex gas pedal at this point in the cycle, the Independents risk ceding share in shale development to the Majors. On Wednesday, Chevron’s 2018 budget release confirmed that this indeed will happen if actions follow words. There’s a lot …

Read More »New Fresh Water Entrant Plans To Pipe Make-Up Water Into Kermit Area Frac Sand Mines

During recent conversations with several Permian Basin industry contacts, we caught wind that a new fresh water entrant is marketing third party fresh water via pipeline to the new construction frac sand mines going in around Kermit. We did a bit more digging and then called the company and received …

Read More »Is It Really Different This Time? [Chart Of The Day]

We believe the recent surge of returns-focus rhetoric from E&Ps is having a considerable impact on consensus expectations for US shale E&P spending. This was evident in our recent survey, where participants expressed a bullish view on y/y oil price trends yet waxed conservative on the spending outlook. In this …

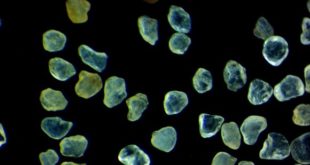

Read More »How Does Permian Basin Dune Sand Look In The Lab? [Charts & Analysis]

For this update, Lonquist & Co. has shared some independently collected West Texas frac sand sample data with Infill Thinking. The results establish some third-party benchmarks for locally-sourced Permian proppant specs. There’s a lot more to this story… Login to see the full update… To read this update and receive our …

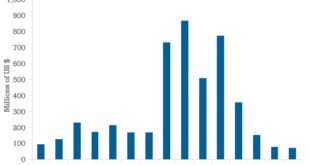

Read More »Land Drilling Rig Capex Is Sinking To New Multi-Decade Lows

As E&P spending continues to recover, land driller spending looks poised to embark on a fourth straight year of decline. Precision Drilling released their 2018 capex program on Monday. We analyze the numbers in this update… There’s a lot more to this story… Login to see the full update… To …

Read More »The Results Of Infill Thinking’s 2018 Outlook Survey Are In…

Last week, we asked readers to answer 13 questions about the outlook for 2018. The focus of our survey was key trends and themes in the US onshore business. Participation was strong, with a diverse mix of respondents – all of whom are well informed on Lower 48 trends. In …

Read More »Market Cap Isn’t The Only Thing Tight Oil Is Taking Away From Offshore Drilling

Since 2013, the offshore drillers have underperformed six other upstream sectors we track by an average of 70%. In this update we look beyond the market cap dislocation at a key hire and recent IPO filings. There’s a lot more to this story… Login to see the full update… To …

Read More »The Long And Short Of Petitioning To List A Species Under The ESA [Guest Post]

Each Friday in the last month of each quarter, we pass our keyboard to an Infill Thinking subscriber to weigh in from their field. In October, two ENGOs provided a notice to the Comptrollers office of their intent to petition the US Fish and Wildlife Service to list the dunes …

Read More »Hiccups And Startups – The Very Latest On The First Nine Permian Basin Frac Sand Mines

Three Permian Basin mines are producing frac sand today. Over the next four months, six more plants are planned to begin commercial production in the Basin. Will all go according to plan? And who will win the race to be the next plant online? We have field-level updates on all …

Read More »Taking The Oilfield’s Temperature On 2018 [Call For Survey Responses]

We poll subscribers on key questions about the 2018 oilfield service outlook. Our Q&A will reveal consensus among some of the industry’s smartest minds about 2018 trends, themes, and debates. To participate and view the results, please login or subscribe. At Infill Thinking, we are very aware of what our …

Read More »This Chart Shows How The Oilfield Service Value Chain Has Been Turned Upside Down

In our weekly rig count update this week, we take a look at how frac sand volume per rig has trended the past few years. Plotting the sand/rig ratio reveals a rapid sea change in the Lower 48 oilfield service value chain. There’s a lot more to this story… …

Read More »The Sand Truck Driver Shortage Is Spilling Over Into Crude Oil Hauling

If oil drivers are leaving for sand in larger numbers now, that would suggest that frac sand hauling rates may have reached a tipping point that converts drivers. We examine the differences in hauling oil vs. sand both pay and scope and discuss a potential tipping point that could have …

Read More »In-Basin Adversary: 40mph Gusts In Kermit/Monahans Just Tested Sand Stockpiles

High winds ripped through the West Texas dune strip during the past couple days, reminding us of fugitive dust and inventory erosion risks. West Texas poses a unique environmental challenge that the frac sand mining industry has never had to deal with at scale before. We believe wind will be …

Read More »H&P Has Plenty Of 2018 Capex Budgeted To Upgrade Their 100+ Super-Spec Rig Candidates

Helmerich & Payne closed out C3Q17 earnings season for the land drillers late-last week. Here are the three statements that we found most interesting… There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a …

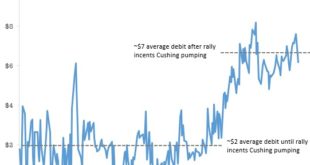

Read More »Are West Texas Producers Unnecessarily Taking A $5/Barrel Hickey?

There’s a new reader-submitted post in our thinking aloud forum, please visit the thread here to read and discuss how (and potentially why) the oil price rally is masking some important disconnects. Emerging discounts are impacting tight oil producers who sell product based of WTI benchmarks, but it may not …

Read More »Two Fatalities In Permian Frac Sand Handling In As Many Months Raise Concerns

This is the kind of update we hate to write. Every O&G company we know goes to great lengths avoid fatal accidents. Few industries emphasize safety as much as O&G. But in a physical business like this, occupational hazards are very real. Our coverage will serve two purposes and two …

Read More »New Frac Sand Entrant Opens A 3mmtpa Permian Mine, Plans Second Site [Exclusive Details, Photos, First Look]

Infill Thinking visited the third Permian Basin frac sand mine to come online back when it was under construction in August. With the plant coming online last week, we share exclusive details from our time on site with management as well as the very latest on the startup from our …

Read More »Frac Sand Scattershooting Beyond The Permian: Eagle Ford Cameo, M&A, Barged Sand, Intensity Debate, and more…

Today we are wrapping up our frac sand scattershooting series with our third installment. feature image used with creative commons license There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If …

Read More »It Took Just Over 400 Frac Sand Trucks To Break A STACK Record [Follow The Leaders]

We did some math on the record breaking well announced by the STACK leader this week. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If you are new to Infill Thinking, …

Read More »Establishing A 2018 Tight Oil E&P Capex Growth Floor? The Most Budget Conscious E&P Set A 16% 2018 Increase Vs. Prior 2017 Plan

Anadarko’s 2018 capital spending program was released Thursday morning. It is one of the first detailed 2018 E&P budgets to be released this budget season. Given their focus on discipline and returns and leadership in crafting a sustainable framework for developing tight oil, Anadarko’s E&P capex budget should help establish …

Read More »In The Nation’s Two Biggest Liquids Plays, It’s A Tale Of Two Cities

In this weekly rig count update, we take a quick look at the rig count evolution of today’s two most important US onshore markets: West Texas and Oklahoma. You may remember the following chart from an update early this year when we wrote about the bifurcated Permian market place…. …

Read More »About 80 Trucks A Day Are Moving Out Of Aequor’s Gates Out In Culberson County Right Now

We checked in with Aequor management out in Culberson County for an update on the Permian Basin’s second online frac sand mine. There’s a lot more to this story… Login to see the full update… To read this update and receive our research newsletters, you must be a member. If …

Read More » Infill Thinking Lifting the O&G knowledge curve

Infill Thinking Lifting the O&G knowledge curve